Virgin Media 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

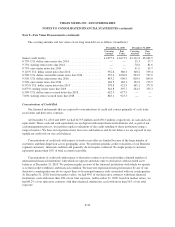

Note 8—Long Term Debt (continued)

conveyance of all, or substantially all, of Virgin Media Inc.’s assets; (iv) the declaration by Virgin Media Inc. of

the distribution of certain rights, warrants, assets or debt securities to all, or substantially all, holders of Virgin

Media Inc.’s common stock; or (v) if Virgin Media Inc. undergoes a fundamental change (as defined in the

indenture governing the convertible senior notes), such as a change in control, merger, consolidation, dissolution

or delisting.

The initial conversion rate is equal to 52.0291 shares of Virgin Media Inc.’s common stock per $1,000 of

convertible senior notes, which represents an initial conversion price of approximately $19.22 per share of

common stock. The conversion rate is subject to adjustment for stock splits, stock dividends or distributions, the

issuance of certain rights or warrants, certain cash dividends or distributions or stock repurchases where the price

exceeds market values. In the event of specified fundamental changes relating to Virgin Media Inc., referred to as

“make whole” fundamental changes, the conversion rate will be increased as provided by a formula set forth in

the indenture governing the convertible senior notes.

Holders may also require us to repurchase the convertible senior notes for cash in the event of a fundamental

change (as defined in the indenture governing the convertible senior notes), such as a change in control, merger,

consolidation, dissolution or delisting (including involuntary delisting for failure to continue to comply with the

NASDAQ listing criteria), for a purchase price equal to 100% of the principal amount, plus accrued but unpaid

interest to the purchase date.

Because the trading price of our common stock exceeded 120% of the conversion price of the convertible

notes for 20 out of the last 30 trading days of 2010, holders of the convertible notes may elect to convert their

convertible notes during the first quarter of 2011. If conversions of this nature occur, we may deliver cash,

common stock, or a combination of both, at our election, to settle our obligations. We have classified this debt as

long-term debt in the consolidated balance sheet as of December 31, 2010 because we determined, in accordance

with the Derivatives and Hedging Topic of the FASB ASC, that we have the ability to settle the obligations in

equity in all circumstances, except in the case of a fundamental change (as defined in the indenture governing the

convertible senior notes). This condition must be fulfilled on 20 of the last 30 trading days of each calendar

quarter. If the condition is not met during that time period, the notes will not be convertible in the following

quarter.

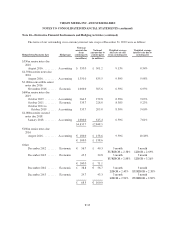

In May 2008, the FASB issued new guidance which requires that the liability and equity components of

convertible debt instruments that may be settled in cash upon conversion (including partial cash settlement) be

separately accounted for in a manner that reflects an issuer’s nonconvertible debt borrowing rate. As a result, the

liability component is recorded at a discount reflecting its below market coupon interest rate, and is subsequently

accreted to its par value over its expected life, with the rate of interest that reflects the market rate at issuance

being reflected in the results of operations. We adopted the guidance on January 1, 2009 as our convertible senior

notes are within the scope of the guidance and we have applied it on a retrospective basis, whereby our prior

period results have been adjusted.

We applied a nonconvertible borrowing rate of 10.35% which resulted in the recognition of a discount on

the convertible senior notes totaling £108.2 million, with the offsetting amount recognized as a component of

additional paid-in capital. In addition, a cumulative translation adjustment of £36.1 million was recognized in

relation to prior periods due to the decrease in the foreign currency denominated debt balance subject to

translation during 2008.

F-25