Virgin Media 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

gains on the principal portion of our U.S. dollar convertible senior notes. The foreign currency gains in the year

ended December 31, 2009 were primarily due to the strengthening of the pound sterling which occurred in the

first six months of the year relative to the U.S. dollar and euro and related foreign exchange gains on the

principal portion of our U.S. dollar convertible senior notes, which is unhedged, and the U.S. dollar and euro

denominated tranches of the previous senior credit facility.

Interest Income and Other, Net

For the year ended December 31, 2010, interest income and other increased to £8.3 million from

£6.2 million for the year ended December 31, 2009, primarily as a result of higher cash balances over the period.

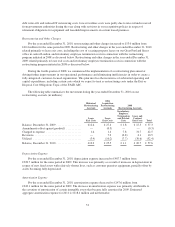

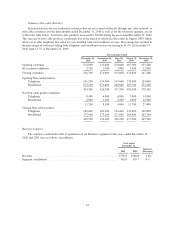

Income Tax Benefit

For the year ended December 31, 2010, income tax benefit was £124.1 million as compared with

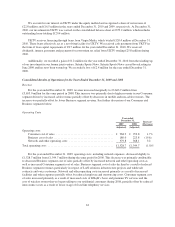

£2.5 million for the same period in 2009. The 2010 and 2009 tax benefit was comprised of (in millions):

2010 2009

Current:

Federal ................................................. £ (4.9) £ 1.5

State and local ........................................... 0.3 (0.1)

Foreign ................................................. 25.0 4.9

Total current ................................................. 20.4 6.3

Deferred:

Federal ................................................. 79.8 (3.8)

Foreign ................................................. 23.9 —

Total deferred ................................................ 103.7 (3.8)

Total ....................................................... £124.1 £ 2.5

The foreign current tax benefit and the foreign deferred tax benefit were primarily driven by the application

of the intraperiod allocation rules of the Income Taxes Topic of the FASB ASC. The foreign current tax benefit

attributable to continuing operations includes £18.3 million related to the gain on discontinued operations and is

offset by tax expense of £18.3 million that is included within discontinued operations. The £23.9 million foreign

deferred tax benefit attributable to continuing operations is offset by tax expense of £23.9 million that is included

within other comprehensive as a result of gains in other comprehensive income during 2010.

Additionally, during 2010 we concluded that it was more likely than not that we would be able to utilize

certain net operating loss carryforwards prior to their expiration, which will occur between 2020 and 2030, to

reduce future U.S. federal income tax liabilities. Accordingly, we reduced the previously established valuation

allowance on these net operating loss carryforwards to nil and recorded a federal deferred tax benefit of

£79.8 million. This change was due to a re-assessment of our intentions regarding certain assets during the

carryforward period and our judgment that it is more likely than not that these NOLs will be utilized prior to

expiry. Actual realization of these net operating loss carry forwards is dependent upon our ability to generate

taxable income from asset sales or operating activities prior to their expiration.

Loss From Continuing Operations

For the year ended December 31, 2010, loss from continuing operations decreased to £169.2 million from a

loss of £350.3 million for the same period in 2009 due to the factors discussed above.

55