Virgin Media 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

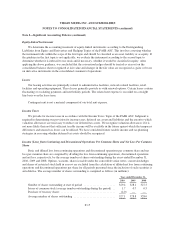

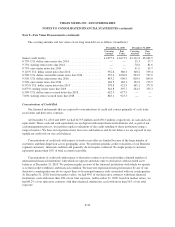

Note 8—Long Term Debt (continued)

•6.50% Senior Secured Notes due January 15,2018—The principal amount at maturity is

$1,000 million. Interest is payable semi-annually on June 15,and December 15 commencing June 15,

2010

•7.00% Senior Secured Notes due January 15,2018—The principal amount at maturity is £875 million.

Interest is payable semi-annually on June 15, and December 15 commencing June 15,2010

•8.375% Senior Notes due October 15, 2019—The principal amount at maturity is $600 million. Interest

is payable semi-annually on April 15 and October 15 commencing April 15, 2010.

•8.875% Senior Notes due October 15, 2019—The principal amount at maturity is £350 million. Interest

is payable semi-annually on April 15 and October 15 commencing April 15, 2010.

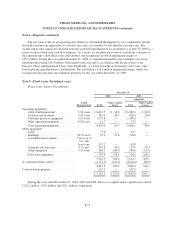

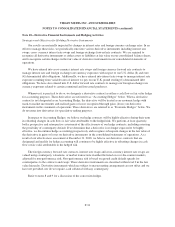

On January 19, 2010, our wholly owned subsidiary Virgin Media Secured Finance PLC issued $1.0 billion

aggregate principal amount of 6.50% senior secured notes due 2018 and £875 million aggregate principal amount

of 7.00% senior secured notes due 2018. Interest is payable on June 15 and December 15 each year, beginning on

June 15, 2010. The senior secured notes due 2018 rank pari passu with our senior credit facility and, subject to

certain exceptions, share in the same guarantees and security which have been granted in favor of our senior

credit facility. We used the net proceeds to make repayments totaling £1,453.0 million under our old senior credit

facility.

On May 12, 2010, we redeemed in full the outstanding balance of our senior notes due 2014 using cash from

our balance sheet. The total cost to redeem these notes was £192.3 million, inclusive of the cost to settle

derivative contracts entered into as economic hedges of these notes.

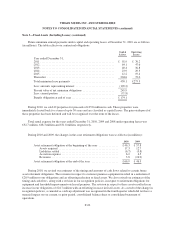

Convertible Senior Notes

On April 16, 2008, Virgin Media Inc. issued U.S. dollar denominated 6.50% convertible senior notes due

2016 with a principal amount outstanding of $1.0 billion and used the proceeds and cash on hand to repay

£504.0 million of our obligations under our senior credit facility that were originally scheduled to be paid in

2009, 2010 and 2012. The convertible senior notes are unsecured senior obligations of Virgin Media Inc. and,

consequently, are subordinated to our obligations under the senior credit facility and rank equally with Virgin

Media Inc.’s guarantees of our senior notes. The convertible senior notes bear interest at an annual rate of 6.50%

payable semi-annually on May 15 and November 15 of each year, beginning November 15, 2008. The

convertible senior notes mature on November 15, 2016 and may not be redeemed by us prior to their maturity

date. Upon conversion, we may elect to settle in cash, shares of common stock or a combination of cash and

shares of our common stock. Based on the December 31, 2010 closing price of our common stock, the ‘if

converted value’ of the convertible senior notes exceeds the outstanding principal amount by approximately

£267.5 million.

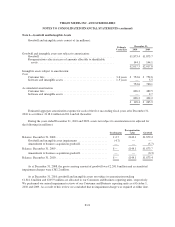

Holders of convertible senior notes may tender their notes for conversion at any time on or after August 15,

2016 through to the second scheduled trading date preceding the maturity date. Prior to August 15, 2016, holders

may convert their notes, at their option, only under the following circumstances: (i) in any quarter, if the closing

sale price of Virgin Media Inc.’s common stock during at least 20 of the last 30 trading days of the prior quarter

was more than 120% of the applicable conversion price per share of common stock on the last day of such prior

quarter; (ii) if, for five consecutive trading days, the trading price per $1,000 principal amount of notes was less

than 98% of the product of the closing price of our common stock and the then applicable conversion rate; (iii) if

a specified corporate event occurs, such as a merger, recapitalization, reclassification, binding share exchange or

F-24