Virgin Media 2010 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

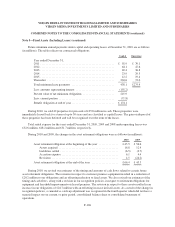

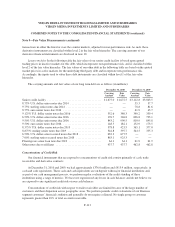

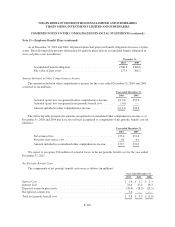

Note 8—Long Term Debt (continued)

On May 12, 2010, we redeemed in full the outstanding balance of our senior notes due 2014 using cash from

our balance sheet. The total cost to redeem these notes was £192.3 million, inclusive of the cost to settle

derivative contracts entered into as economic hedges of these notes.

Senior Credit Facility

The principal amount outstanding under our senior credit facility at December 31, 2010 was

£1,675.0 million. Our senior credit facility comprises a term facility denominated in pounds sterling,

£1,675.0 million, and a revolving facility of £250.0 million. At December 31, 2010, £1,675.0 million of the term

facility had been drawn and £15.8 million of the revolving credit facility had been utilized for bank guarantees

and standby letters of credit.

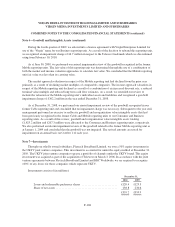

The senior credit facility bears interest at LIBOR, plus a margin currently ranging from 2.75% to 3.75% and

the applicable cost of complying with any reserve requirement. The margins on £1,000.0 million of the term loan

A facilities and on the revolving credit facility ratchet range from 2.75% to 3.50% based on leverage ratios.

Interest is payable at least semi-annually. Principal repayments in respect of £1,000.0 million of the term loan A

facilities are due annually beginning in June 2011 and ending in June, 2015, and the remaining term loan B

facility is repayable in full on its maturity dates which is December 31, 2015.

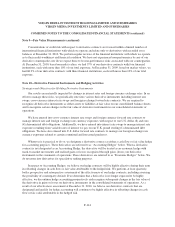

On April 19, 2010, we drew down an aggregate principal amount of £1,675.0 million under our new senior

credit facility dated March 16, 2010, as amended and restated, or the new senior credit facility, and applied the

proceeds towards the repayment of all amounts outstanding under our old senior credit facility and for general

corporate purposes.

The facility is secured through a guarantee from Virgin Media Finance. In addition, the bulk of the facility is

secured through guarantees and first priority pledges of the shares and assets of substantially all of our operating

subsidiaries and of receivables arising under any intercompany loans to those subsidiaries. We are subject to

financial maintenance tests under the facility, including a test of liquidity, coverage and leverage ratios applied to

us and certain of our subsidiaries. As of December 31, 2010, we were in compliance with these covenants.

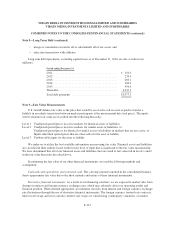

The agreements governing the senior secured notes and the senior credit facility significantly, and, in some

cases, absolutely restrict our ability and the ability of most of our subsidiaries to:

• incur or guarantee additional indebtedness;

• pay dividends at certain levels of leverage, or make other distributions, or redeem or repurchase equity

interests or subordinated obligations;

• make investments;

• sell assets, including the capital stock of subsidiaries;

• enter into sale and leaseback transactions or certain vendor financing arrangements;

• create liens;

• enter into agreements that restrict the restricted subsidiaries’ ability to pay dividends, transfer assets or

make intercompany loans;

F-111