Virgin Media 2010 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 3—Recent Accounting Pronouncements (continued)

In February 2010, the FASB issued new guidance for the disclosure of subsequent events. As a result of this

guidance, we are no longer required to disclose the date through which we have evaluated subsequent events in

the financial statements. We have adopted the disclosure requirements of this standard which did not have a

material impact on our consolidated financial statements.

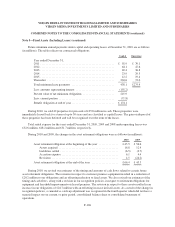

Note 4—Disposals

Disposal of Virgin Media TV

On June 4, 2010, we announced the sale to BSkyB of our television channel business known as Virgin

Media TV. Virgin Media TV’s operations comprised our former Content segment. We determined that as of

June 30, 2010 the planned sale met the requirements for Virgin Media TV to be reflected as assets and liabilities

held for sale and discontinued operations in both the current and prior years and, accordingly, we adjusted the

consolidated balance sheet as of December 31, 2009 and consolidated statements of operations and cash flows for

the years ended December 31, 2009 and 2008.

We have also entered into a number of agreements providing for the carriage by us of certain of BSkyB’s

standard and high-definition channels along with the former Virgin Media TV channels sold. The agreements in

respect to the sale of Virgin Media TV and the carriage of these channels were negotiated concurrently. We have

determined that these agreements are separate units of account as described by the fair value measurements

guidance issued by the FASB. We have performed a review of the fair value of the services received and the

business disposed of to determine the appropriate values to attribute to each unit of account. As a result,

£33.6 million of the gain on disposal of Virgin Media TV was deferred within other liabilities on the balance

sheet and will be treated as a reduction in operating costs over the contractual terms of the carriage arrangements,

which range from 3 to 7 years. During 2010, £2.0 million of this deferred gain was recognized in the

consolidated statement of operations.

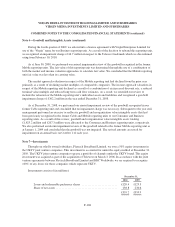

The fair value of Virgin Media TV was determined utilizing the market approach along with other third

party bids we received for the business. The market approach utilized market multiples for similar businesses

along with indicative earnings before interest, tax, depreciation and amortization, or EBITDA, levels for the

business. The fair value of the carriage agreements was estimated utilizing an analysis of the cost of carriage

agreements with other suppliers of content, prices proposed or established by U.K. regulators and audience

viewing data. Along with this, we utilized a discount rate of 9.5%. These fair value measurements utilize

significant unobservable inputs and fall within Level 3 of the fair value hierarchy.

The results of operations of Virgin Media TV have been included as discontinued operations in the

consolidated statements of operations through July 12, 2010, which is the date the sale was completed following

approval from regulators in Ireland. On that date, consideration was received totaling £105.0 million. On

September 17, 2010, additional consideration of £55.0 million was received upon full approval of the transaction

by U.K. regulators. The terms of the sale and purchase agreement include customary warranties, guarantees and

working capital adjustments which may impact the amount recognized in future periods. No U.K. income tax is

due as a result of the gain on disposal of Virgin Media TV due to our ability to offset capital losses and capital

allowances against this income. The tax expense associated with the gain on disposal in the consolidated

statements of operations is offset with an equal tax benefit in continuing operations.

F-102