Virgin Media 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On July 28, 2010, we announced our intention to undertake a range of capital structure optimization actions.

This capital structure optimization program is expected to include the application of, in aggregate, up to

£700 million, in part towards repurchases of up to £375 million of our common stock until August 2011 and in

part towards transactions relating to our debt and convertible debt, including related derivative transactions, such

as the conversion hedge transaction described below.

On October 27, 2010, we entered into conversion hedges with certain counterparties relating to our

$1.0 billion 6.50% convertible senior notes due 2016. These transactions are intended to offset a portion of the

dilutive effects that could potentially be associated with conversion of the convertible senior notes at maturity

and provide us with the option to receive the number of shares of our common stock (or in certain circumstances

cash) with a value equal to the excess of (x) the value owed by us (up to the cap price of $35.00 per share) to

convertible senior note investors pursuant to the terms of the notes on conversion of up to 90% of the notes over

(y) the aggregate face amount of such converted notes upon maturity of the convertible senior notes. The

conversion hedges also provide various mechanisms for settlement in the Company’s common stock and/or cash

in certain circumstances, based primarily on the settlement method elected for the notes. These options have an

initial strike price of $19.22 per share of our stock, which is the conversion price provided under the terms of our

convertible senior notes, and a cap price of $35.00 per share of our stock. We paid £205.4 million in respect of

the conversion hedges transactions during the fourth quarter. The cost of these transactions was not deductible

for U.S. federal income tax purposes, and the proceeds, if any, received upon exercise of the options will not be

taxable for U.S. federal income tax purposes.

During the year ended December 31, 2010, we repurchased approximately 9.3 million shares of common

stock, at an average purchase price per share of $20.78, through an accelerated stock repurchase program for an

aggregate purchase price of $194.0 million, or £122.5 million, and approximately 2.3 million shares of common

stock, at an average purchase price per share of $26.82, through an open market repurchase program for an

aggregate purchase price of $61.7 million, or £39.0 million. The shares of common stock acquired in connection

with these programs have been cancelled. As of February 18, 2011, the remaining amount authorized for

repurchase under this plan is £213.5 million (or $333.0 million based on the exchange rate at December 31,

2010).

Our long term debt has been issued by Virgin Media Inc. and certain of its subsidiaries that have no

independent operations or significant assets other than investments in their respective subsidiaries and affiliates.

As a result, they will depend upon the receipt of sufficient funds from their respective subsidiaries to meet their

obligations. In addition, the terms of our existing and future indebtedness and the laws of the jurisdictions under

which our subsidiaries are organized limit the payment of dividends, loan repayments and other distributions

from them under many circumstances.

Our debt agreements contain restrictions on our ability to transfer cash between groups of our subsidiaries.

As a result of these restrictions, although our overall liquidity may be sufficient to satisfy our obligations, we

may be limited by covenants in some of our debt agreements from transferring cash to other subsidiaries that

might require funds. In addition, cross default provisions in our other indebtedness may be triggered if we default

on any of these debt agreements.

We may opportunistically access the loan and debt markets in order to extend debt maturities and to seek

improved debt terms.

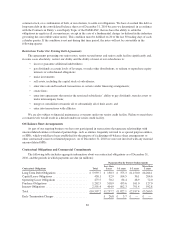

Senior Credit Facility

On March 16, 2010, we entered into a senior facilities agreement (as amended and restated on March 26,

2010 and February 15, 2011), or the Senior Facilities Agreement, under which Deutsche Bank AG, London

Branch, BNP Paribas London Branch, Bank of America, N.A., Crédit Agricole Corporate and Investment Bank,

GE Corporate Finance Bank SAS, Goldman Sachs Lending Partners LLC, J.P. Morgan Chase Bank, N.A.

London Branch, Lloyds TSB Bank plc, The Royal Bank of Scotland plc and UBS Limited agreed to make

available to certain subsidiaries of the Company a term loan A facility, or Tranche A, and a revolving credit

75