Virgin Media 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

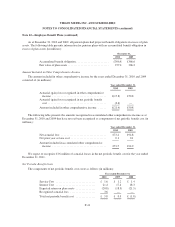

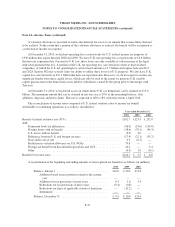

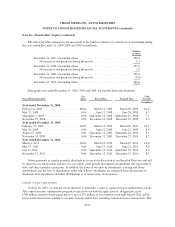

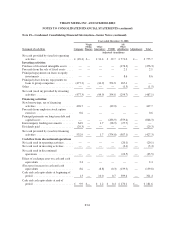

Note 16—Shareholders’ Equity (continued)

program may be effected through open market, privately negotiated, and/or derivative transactions, and may be

implemented through arrangements with one or more brokers. Any shares of common stock acquired in

connection with this program will be held in treasury or cancelled. See Note 8 for a discussion of the conversion

hedges related to our convertible senior notes which were entered into as part of this program.

During year ended December 31, 2010, we repurchased 11.6 million shares of common stock in connection

with this program, at an average purchase price per share of $21.98 (£161.5 million in aggregate), through an

accelerated stock repurchase program and open market repurchases. The shares of common stock acquired in

connection with this program were cancelled. As at December 31, 2010, the remaining amount authorized under

the share repurchase program was £213.5 million. No shares of common stock were repurchased in the year

ended December 31, 2009.

Series A Warrants

On January 10, 2003, we issued Series A warrants to some of our former creditors and stockholders. The

Series A warrants were initially exercisable for a total of 8,750,496 shares of common stock at an exercise price

of $309.88 per share. After adjustment to account for the rights offering and the reverse acquisition of Telewest

in accordance with anti-dilution adjustment provisions, the Series A warrants were exercisable for a total of

25,769,060 shares of our common stock at an exercise price of $105.17 per share. The Series A warrants expired

on January 10, 2011.

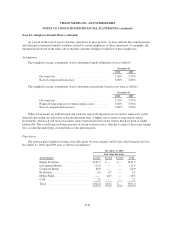

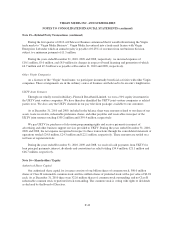

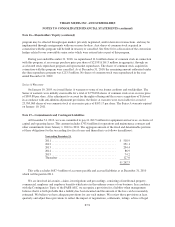

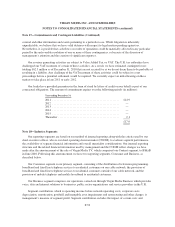

Note 17—Commitments and Contingent Liabilities

At December 31, 2010, we were committed to pay £1,262.5 million for equipment and services, exclusive of

capital and operating leases. This amount includes £743.6 million for operations and maintenance contracts and

other commitments from January 1, 2012 to 2031. The aggregate amount of the fixed and determinable portions

of these obligations for the succeeding five fiscal years and thereafter is as follows (in millions):

Year ending December 31:

2011 ............................................. £ 518.9

2012 ............................................. 251.1

2013 ............................................. 204.4

2014 ............................................. 86.9

2015 ............................................. 74.2

Thereafter ........................................ 127.0

£1,262.5

This table excludes £687.4 million of accounts payable and accrued liabilities as at December 31, 2010

which will be paid in 2011.

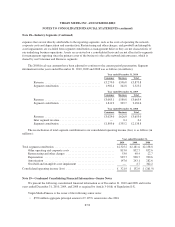

We are involved in lawsuits, claims, investigations and proceedings, consisting of intellectual property,

commercial, employee and employee benefits which arise in the ordinary course of our business. In accordance

with the Contingencies Topic of the FASB ASC, we recognize a provision for a liability when management

believes that it is both probable that a liability has been incurred and the amount of the loss can be reasonably

estimated. We believe we have adequate provisions for any such matters. We review these provisions at least

quarterly and adjust these provisions to reflect the impact of negotiations, settlements, rulings, advice of legal

F-51