Virgin Media 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Depreciation Expense

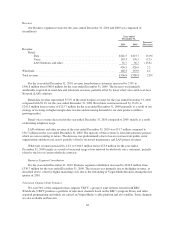

For the year ended December 31, 2009, depreciation expense increased to £928.7 million from

£900.6 million for the same period in 2008. This increase was primarily as a result of increases in depreciation in

respect of new fixed assets partially offset by assets becoming fully depreciated.

Amortization Expense

For the year ended December 31, 2009, amortization expense decreased to £243.1 million from

£282.6 million for the same period in 2008. The decrease in amortization expense was primarily attributable to

the cessation of amortization of certain intangible assets that are now fully amortized.

Goodwill and Intangible Asset Impairments

In the first quarter of 2010, we rebranded our Business reporting unit utilizing the Virgin trademarks. As a

result, we recorded an impairment expense of £4.7 million as at December 31, 2009 for the Telewest trademark.

We performed our annual impairment reviews for our Content reporting unit as at June 30, 2009 and our

Business and Consumer reporting units as at October 1, 2009. As a result of these reviews we concluded that the

fair values of the reporting units exceeded their carrying values.

We performed our annual impairment review for our former Mobile, Virgin Media TV and sit-up reporting

units as at June 30, 2008. As a result of this review we concluded that the fair values of the Virgin Media TV and

sit-up reporting units exceeded their carrying value, while the Mobile reporting unit’s fair value was less than its

carrying value. The fair value of the Mobile reporting unit as at June 30, 2008 was determined through the use of

a combination of both market and income valuation approaches to calculate fair value. The market approach

valuations in respect of the Mobile reporting unit declined from the prior year primarily as a result of declining

market multiples of comparable companies. The income approach valuations in respect of the Mobile reporting

unit declined as a result of a combination of an increased discount rate, a reduced terminal value multiple and

reduced long term cash flow estimates. As a result, we recorded an impairment charge of £362.2 million in

relation to this reporting unit in the year ended December 31, 2008.

As at December 31, 2008, we performed our annual impairment review of the goodwill recognized in our

former Cable segment and concluded that its fair value exceeded its carrying value.

Interest Expense

For the year ended December 31, 2009, interest expense decreased to £455.1 million from £499.3 million

for the same period in 2008, mainly as a result of lower interest rates and lower debt balances following the

prepayments made in 2008.

We paid cash interest of £404.2 million for the year ended December 31, 2009 and £515.8 million for the

year ended December 31, 2008. The decrease in cash interest payments was primarily due to differences in the

timing of interest payments on our senior credit facility, together with lower interest rates and debt balances as

described above.

Loss on Extinguishment of Debt

For the year ended December 31, 2009, loss on extinguishment of debt was £54.5 million which related to

the write off of deferred financing costs as a result of the partial repayments of our senior credit facility in 2009

and the call premium totaling £30.3 million on the repayment of a portion of the senior notes due 2014. For the

year ended December 31, 2008, loss on extinguishment of debt was £9.6 million which related to the write off of

deferred financing costs as a result of the prepayment of £804.0 million under our senior credit facility during

2008.

65