Virgin Media 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

debt write-offs and reduced IT outsourcing costs. Lower facilities costs were partly due to rates refunds received

from government authorities during the year along with revisions in our recognition policies in respect of

retirement obligations for equipment and leasehold improvements on certain leased premises.

Restructuring and Other Charges

For the year ended December 31, 2010, restructuring and other charges increased to £53.0 million from

£40.4 million for the same period in 2009. Restructuring and other charges in the year ended December 31, 2010

related primarily to lease exit costs, including the cost of vacating property leases on our Great Portland Street

office in central London, and involuntary employee termination costs in connection with the restructuring

program initiated in 2008 as discussed below. Restructuring and other charges in the year ended December 31,

2009 related primarily to lease exit costs and involuntary employee termination costs in connection with the

restructuring program initiated in 2008 as discussed below.

During the fourth quarter of 2008, we commenced the implementation of a restructuring plan aimed at

driving further improvements in our operational performance and eliminating inefficiencies in order to create a

fully-integrated, customer-focused organization. This plan involves the incurrence of substantial operating and

capital expenditures, including certain costs which we expect to treat as restructuring costs under the Exit or

Disposal Cost Obligations Topic of the FASB ASC.

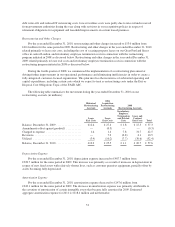

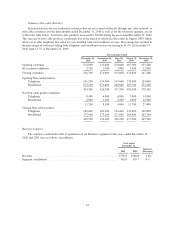

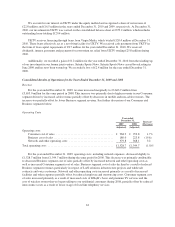

The following table summarizes the movement during the year ended December 31, 2010 on our

restructuring accruals (in millions):

Historical

Restructuring

Accruals

2006

Acquisition

Restructuring

Accruals

2008

Restructuring Accruals

Total

Lease

Exit Costs

Lease

Exit Costs

Involuntary

Employee

Termination

and Related

Costs

Lease and

Contract

Exit Costs

Balance, December 31, 2009 .................. £12.6 £ 27.4 £ 1.8 £ 15.5 £ 57.3

Amendments offset against goodwill ........... — (0.3) — — (0.3)

Charged to expense ......................... 1.6 1.4 7.8 31.7 42.5

Revisions ................................. — 7.2 (0.8) 4.1 10.5

Utilized .................................. (3.9) (10.2) (7.7) (30.6) (52.4)

Balance, December 31, 2010 .................. £10.3 £ 25.5 £ 1.1 £ 20.7 £ 57.6

Depreciation Expense

For the year ended December 31, 2010, depreciation expense increased to £987.7 million from

£928.7 million for the same period in 2009. This increase was primarily as a result of increases in depreciation in

respect of new fixed assets with relatively shorter lives, such as customer premises equipment, partially offset by

assets becoming fully depreciated.

Amortization Expense

For the year ended December 31, 2010, amortization expense decreased to £147.6 million from

£243.1 million for the same period in 2009. The decrease in amortization expense was primarily attributable to

the cessation of amortization of certain intangible assets that became fully amortized in 2009. Estimated

aggregate amortization expense for 2011 is £118.4 million and nil thereafter.

53