US Airways 2003 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

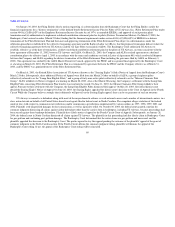

amortized as compensation expense (an element of Personnel costs) in the statement of operations over the vesting period. The Company has disclosed in

Note 2(m) the effect on net income (loss) as if the fair value based recognition provisions of SFAS 123 had been applied to all outstanding and unvested stock

option awards in each Predecessor Company period presented.

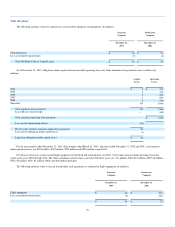

Class A Common Stock of US Airways Group allocated to employees pursuant to collective bargaining agreements of 23,028,687 shares were valued at

$169 million in the aggregate and were included as deferred compensation as a reduction to Stockholder's Equity (Deficit) upon emergence. US Airways

records the deferred compensation as compensation expense as the related shares vest.

There are 3,750,000 shares of US Airways Group Class A Common Stock and 2,220,570 each of Class A-1 Warrants and shares of Class A Preferred

Stock authorized to be granted to US Airways' management pursuant to US Airways Group's Plan of Reorganization. Through December 31, 2003, 3,627,923

shares of Class A Common Stock and 2,216,527 each of Class A-1 Warrants and shares of Class A Preferred Stock were granted to US Airways'

management. Grants made to certain senior management employees on July 31, 2003 were approved by US Airways Group's Human Resources Committee

reflecting an allocation of 62 percent Class A Common Stock and 38 percent Class A-1 Warrants and Class A Preferred Stock of US Airway Group, while

grants made to other management employees were granted using an allocation of 60 percent Class A Common Stock and 40 percent Class A-1 Warrants and

Class A Preferred Stock of US Airways Group. The agreements for all grants were drafted using the ratio of 60 percent and 40 percent, respectively, with the

result that the agreements for the senior officers reflected the incorrect amounts of stock and warrants. The agreements for the senior officers have

subsequently been revised, effective as of the date of grant, to reflect the correct grant amounts.

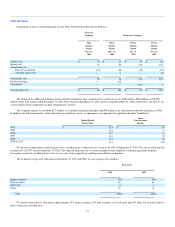

US Airways recognized compensation expense related to US Airways Group Class A Common Stock and stock warrant grants to US Airways'

employees of $135 million for the nine months ended December 31, 2003.

There were 2,216,527 stock warrants outstanding at December 31, 2003, all of which had an exercise price of $7. This included new grants of

2,227,577 stock warrants and forfeitures of 11,050 stock warrants for the nine months ended December 31, 2003. The weighted-average remaining contractual

life at December 31, 2003 was 6.3 years. There were 1,208,077 stock warrants exercisable at December 31, 2003 at a weighted-average exercise price of $7.

The weighted average fair value per stock warrant was $3 for the nine months ended December 31, 2003. The weighted average fair value per share of

Class A Common Stock granted associated with stock warrant grants was $7. In order to calculate the stock-based compensation using the fair value method

provisions in SFAS 123, the Company used the Black-Scholes stock option pricing model with the following weighted-average assumptions for the nine

months ended December 31, 2003: stock volatility of 65.0%; risk-free interest rates of 2.2%; expected stock warrant lives of three years; and no dividend

yield in each period.

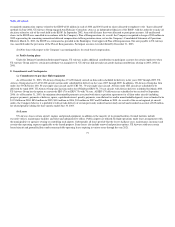

(b) Predecessor Company

US Airways accounted for deferred compensation and the related amortization by applying the provisions of APB 25 and related interpretations. In

accordance with APB 25, deferred compensation related to grants of US Airways Group common stock to employees (Stock Grants) was recognized based on

the fair market value of the stock on the date of grant. Except on limited occasions, no deferred compensation was recognized when options to purchase US

Airways Group common stock were granted to employees (Option Grants) because the exercise price of the stock options was set equal to the fair market

value of the underlying stock on the date of grant. Any deferred compensation was amortized as Personnel costs over the applicable vesting period.

85