US Airways 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

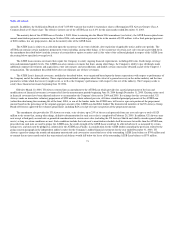

(o) Selling expenses

Selling expenses include commissions, credit card fees, computerized reservations systems fees and advertising and promotional expenses. Advertising

and promotional expenses for the nine months ended December 31, 2003, three months ended March 31, 2003, and twelve months ended December 31, 2002

and 2001 were $15 million, $5 million, $30 million and $28 million, respectively (such costs are expensed when incurred).

(p) Recent Accounting Pronouncements

In January 2003, the Financial Accounting Standards Board (FASB) issued Interpretation No. 46 (FIN 46), "Consolidation of Variable Interest

Entities." An entity is subject to FIN 46 and is called a variable interest entity (VIE) if it has (1) equity that is insufficient to permit the entity to finance its

activities without additional subordinated financial support from other parties, or (2) equity investors that cannot make significant decisions about the entity's

operations, or that do not absorb the expected losses or receive the expected returns of the entity. A VIE is consolidated by its primary beneficiary, which is

the party involved with the VIE that has a majority of the expected losses or a majority of the expected residual returns or both, as a result of ownership,

contractual or other financial interests in the VIE. The Company believes the adoption of FIN 46 does not materially affect its financial statements. In

reaching this conclusion, the Company identified certain lease arrangements that were within the scope of FIN 46. This included a review of 62 aircraft

operating leases for which the Company is the lessee and a pass through trust established specifically to purchase, finance and lease the aircraft to the

Company served as lessor. These trusts, which issue certificates (also known as "Enhanced Equipment Trust Certificates" or "EETC"), allow the Company to

raise the financing for several aircraft at one time and place such funds in escrow pending the purchase or delivery of the relevant aircraft. The trusts are also

structured to provide for certain credit enhancements, such as liquidity facilities to cover certain interest payments, that reduce the risks to the purchasers of

the trust certificates and, as a result, reduce the cost of aircraft financing to the Company. Each of these leases contains a fixed-price purchase option that

allows the Company to purchase the aircraft at predetermined prices on specified dates during the latter part of the lease term. However, the Company does

not guarantee the residual value of the aircraft. As of December 31, 2003, future lease payments required under these leases totaled $2.96 billion. Based on its

cash flow analysis, the Company believes that it is not the primary beneficiary under these lease arrangements. The Company also reviewed long-term

operating leases at a number of airports, including leases where the Company is also the guarantor of the underlying debt. Such leases are typically with

municipalities or other governmental entities. FIN 46, as revised in December 2003, provided a scope exception that generally precludes the consolidation of

governmental organization or financing entities established by a governmental organization. The Company believes that its arrangements meet the scope

exception.

62