US Airways 2003 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

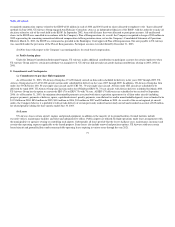

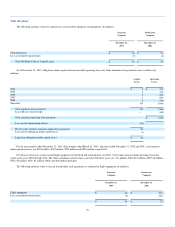

annually. In addition, the Stabilization Board received 7,635,000 warrants that enable it to purchase shares of Reorganized US Airways Group's Class A

Common Stock at $7.42 per share. The effective interest rate of the ATSB Loan was 6.0% for the nine months ended December 31, 2003.

The maturity date of the ATSB Loan is October 1, 2009. Prior to entering into the March 2004 amendment (see below), the ATSB Loan required semi-

annual amortization payments commencing in October 2006, each amortization payment to be in the amount of $125 million, with a final principal payment

of $226 million, less any prepayments, due on the maturity date of the ATSB Loan.

The ATSB Loan is subject to acceleration upon the occurrence of an event of default, after expiration of applicable notice and/or cure periods. The

ATSB Loan contains certain mandatory prepayment events including, among other things, (i) the occurrence of certain asset sales (except as provided for in

the amendment described below) and the issuance of certain debt or equity securities and (ii) the value of the collateral pledged in respect of the ATSB Loan

decreasing below specified coverage levels.

The ATSB Loan contains covenants that require the Company to satisfy ongoing financial requirements, including debt ratio, fixed charge coverage

ratio and minimum liquidity levels. The ATSB Loan also contains covenants that limit, among other things, the Company's ability to pay dividends, make

additional corporate investments and acquisitions, enter into mergers and consolidations and modify certain concessions obtained as part of the Chapter 11

reorganization. The amendment described below does not eliminate any of these covenants.

The ATSB Loan's financial covenants, modified as described below, were negotiated based upon the future expectations with respect to performance of

the Company and of the airline industry. These expectations included assumptions about the extent of a general recovery in the airline industry and the time

parameters within which that recovery might occur, as well as the Company's performance with respect to the rest of the industry. The Company needs to

satisfy these financial covenants beginning June 30, 2004.

Effective March 12, 2004, US Airways entered into an amendment to the ATSB Loan which provides for a partial prepayment of the loan and

modifications of financial covenants (covenant relief) for the measurement periods beginning June 30, 2004 through December 31, 2005. Existing ratios used

in financial covenants have been adjusted and reset to accommodate the Company's forecast for 2004 and 2005. In exchange for this covenant relief, US

Airways made an immediate voluntary prepayment of $250 million, which reduced, pro rata, all future scheduled principal payments of the ATSB Loan

(rather than shortening the remaining life of the loan). RSA, as one of the lenders under the ATSB Loan, will receive a pro rata portion of the prepayment

amount based on the percentage of the original aggregate amount of the ATSB Loan that RSA funded. The disinterested members of the US Airways Group

Board of Directors approved the voluntary prepayment, including RSA's receipt of its pro rata portion of the prepayment amount.

The amendment also provides for US Airways to retain, at its election, up to 25% of the net cash proceeds from any asset sale up to a total of $125

million to the extent that, among other things, definitive documentation for such asset sales is completed by February 28, 2005. In addition, US Airways may

now accept a third party secured note as permitted consideration for certain asset sales (including the US Airways Shuttle and wholly owned regional airline

assets) as long as certain conditions are met. Such conditions include that such note's amortization schedule shall be no more favorable than the ATSB Loan,

proceeds from such note are used to prepay the ATSB Loan, the credit strength of the ATSB Loan would not be affected adversely as measured by certain

ratings tests, and such note be pledged as collateral for the ATSB Loan. Finally, in consideration for the ATSB lenders amending the provision related to the

going concern paragraph in the independent auditor's report for the Company's audited financial statements for the year ended December 31, 2003, US

Airways agreed to change the month end minimum unrestricted cash covenant to exceed the lesser of the outstanding ATSB Loan balance or $700 million and

to commit that no intra-month end of day unrestricted cash balance would fall below the lesser of the outstanding ATSB Loan balance or $575 million.

71