US Airways 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

programs; (d) honor obligations arising prior to the Petition Date related to the Company's interline, clearinghouse, code sharing and other similar agreements;

(e) pay certain pre-petition taxes and fees, including transportation excise taxes, payroll taxes and passenger facilities charges; and (f) pay certain other

obligations. Substantially all other pre-petition liabilities not mentioned above were classified as Liabilities Subject to Compromise at December 31, 2002.

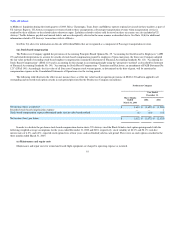

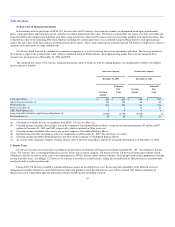

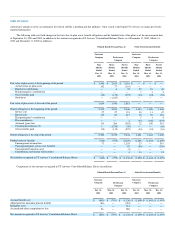

The following table summarizes the components of Liabilities Subject to Compromise included in the Company's Consolidated Balance Sheets as of

December 31, 2002 (in millions):

Debt $3,248

Aircraft-related accruals and deferrals 1,008

Accounts payable 344

Other accrued expenses 294

Deficiency claims and other 609

Total Liabilities Subject to Compromise $5,503

4. Financial Instruments

(a) General

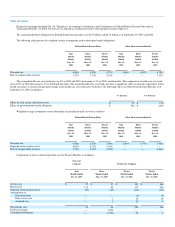

On January 1, 1998, as part of a comprehensive information technology services agreement with Sabre, US Airways was granted two tranches of stock

options (SHC Stock Options) to acquire up to 6,000,000 shares of Class A Common Stock, $.01 par value, of Sabre Holdings Corporation (SHC Common

Stock), Sabre's parent company. Each tranche included 3,000,000 stock options. In December 1999, US Airways exercised the first tranche of stock options at

an exercise price of $27 per option and received proceeds of $81 million in January 2000 in lieu of receiving SHC Common Stock. Realized gains resulting

from the exercise of Sabre options are subject to a clawback provision. Under the clawback provision, if US Airways elects to terminate its information

technology service agreement with Sabre it will be required to pay Sabre an amount equal to the gain multiplied by the ratio of the remaining months in the

contract period over 180 months. The deferred gain from the 1999 exercise is amortized on a straight-line basis over a contractually determined period ending

December 2012. In February 2000, SHC declared a cash dividend resulting in a dilution adjustment to the terms of the second tranche. The adjusted terms of

the second tranche include stock options to acquire 3,406,914 shares of SHC Common Stock at an exercise price of $23.78 subject to an $111.83 per share

cap on the fair market value of the underlying common stock. These options are exercisable during a ten-year period beginning January 2, 2003.

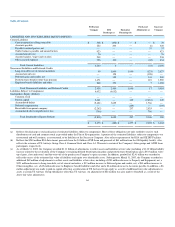

The Company utilizes fixed price swap agreements, collar structures and other similar instruments to manage its exposure related to jet fuel price

changes. During the nine months ended December 31, 2003 and three months ended March 31, 2003, the Company recognized gains of approximately $14

million and $27 million, respectively, related to its fuel hedging activities including a gain of $4 million related to hedge ineffectiveness in the three months

ended March 31, 2003. During 2002, the Company recognized gains of approximately $18 million including a gain of $1 million related to hedge

ineffectiveness. These recognized gains were primarily included in Aviation Fuel on the Company's Consolidated Statements of Operations. As of December

31, 2003, the Company had open fuel hedge positions in place to hedge 30% of its 2004 anticipated jet fuel requirements and 5% of its 2005 anticipated jet

fuel requirements. The Company had $31 million of unrealized gains related to fuel hedge positions recorded in Accumulated other comprehensive loss, net

of income tax effect on its Consolidated Balance Sheet as of December 31, 2003. These gains are expected to be realized in 2004 and 2005 results.

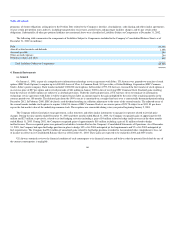

US Airways routinely reviews the financial condition of each counterparty to its financial contracts and believes that the potential for default by any of

the current counterparties is negligible.

66