US Airways 2003 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

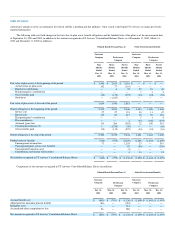

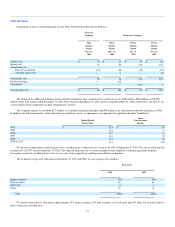

(c) Regional jet capacity purchase agreements

US Airways has entered into capacity purchase agreements with certain regional jet operators. The capacity purchase agreements provide that all

revenues (passenger, mail and freight) go to US Airways. In return, US Airways agrees to pay predetermined fees to the regional airlines for operating an

agreed number of aircraft, without regard to the number of passengers onboard. In addition, these agreements provide that certain variable costs, such as fuel

and airport landing fees, will be reimbursed 100% by US Airways. US Airways controls marketing, scheduling, ticketing, pricing and seat inventories. The

regional jet capacity purchase agreements have expirations from 2008 to 2014 and provide for optional extensions at the Company's discretion. The future

minimum noncancelable commitments under the regional jet capacity purchase agreements are $341 million in 2004, $245 million in each of the years 2005,

2006 and 2007, $233 million in 2008 and $529 million thereafter.

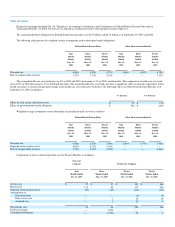

(d) Legal Proceedings

Under the Plan of Reorganization, all claims that arose or accrued prior to the Effective Date against the Filing Entities are subject to the terms of the

Plan of Reorganization and any attempt to collect, secure or enforce remedies with respect to such claims against the Company outside of the claims

administration process set forth in the Plan of Reorganization are, with few exceptions, enjoined under the terms of the Plan of Reorganization and applicable

law. The Chapter 11 case is discussed in greater detail in Note 1 to the Consolidated Financial Statements.

On February 26, 2004, a company called I.A.P. Intermodal, LLC filed suit against US Airways Group and its wholly owned airline subsidiaries alleging

that the defendants infringed upon three patents held by plaintiffs, all of which patents are entitled "Method to Schedule a Vehicle in Real-Time to Transport

Freight and Passengers." Plaintiff seeks various injunctive relief as well as costs, fees and treble damages. US Airways Group has not yet been formally

served but has received a courtesy copy of the complaint. US Airways Group is unable to ascertain at this time the likelihood or potential scale of liability. It

should be noted that on the same date, the same plaintiff filed what we believe to be substantially similar cases against nine other major airlines, including

British Airways, Northwest Airlines Corp., Korean Air Lines Co. Ltd., Deutsche Lufthansa AG, Air France, Air Canada, Singapore Airlines Limited, Delta

Airlines and Continental Airlines, and had filed a suit against the parent company of American Airlines in December, 2003.

The Port Authority of New York and New Jersey filed a proof of claim against US Airways in the bankruptcy proceeding. The claim was in the amount

of $8.5 million and it alleged environmental contamination and building deficiencies at LaGuardia Airport. US Airways' liability and defenses to such liability

were unaffected by its bankruptcy. US Airways has received no notice, inquiry or other communication from the Port Authority other than in connection with

the proof of claim, and therefore is unable to evaluate at this time the validity of the underlying claim, the degree to which US Airways might share

responsibility with other parties, or the cost of cleanup or correction of the alleged building deficiencies.

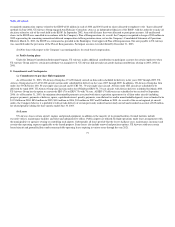

On January 7, 2003, the Internal Revenue Service (IRS) issued a notice of proposed adjustment to US Airways Group proposing to disallow $573

million of capital losses that US Airways Group sustained in the tax year 1999 on the sale of stock of USLM Corporation (USLM). On February 5, 2003, the

IRS filed a proof of claim with the Bankruptcy Court asserting the following claims with respect to USLM: (1) secured claims for U.S. federal income tax and

interest of $0.7 million; (2) unsecured priority claims for U.S. federal income tax of $68 million and interest of $14 million; and (3) an unsecured general

claim for penalties of $25 million. On May 8, 2003, US Airways Group reached a tentative agreement with the IRS on the amount of U.S. federal income

taxes, interest, and penalties due subject to final approval from the Joint Committee on Taxation. By letter dated September 11, 2003, US Airways Group was

notified that the Joint Committee on Taxation had accepted the tentative agreement with the IRS, including a settlement of all federal income taxes through

the end of 2002.

79