US Airways 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Liquidity and Capital Resources

As discussed in "Results of Operations" above, the Successor Company's financial statements are not comparable with the Predecessor Company's

financial statements. However, for purposes of discussion of liquidity and capital resources, full year 2003 has been compared to 2002 as included, in part, in

the Company's Consolidated Statements of Cash Flows (which are contained in Part II, Item 8 of this report).

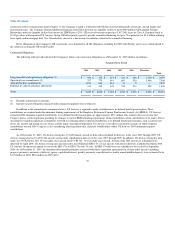

As of December 31, 2003, the Company's Cash, Cash equivalents and Short-term investments totaled $1.28 billion compared to $629 million as of

December 31, 2002 (the Company's Consolidated Balance Sheets are contained in Part II, Item 8 of this report).

The Company continues to be highly leveraged. Substantially all of its assets including aircraft and engines are subject to liens securing indebtedness.

The Company requires substantial working capital in order to meet scheduled debt and lease payments and to finance day-to-day operations. The Company

needs to satisfy covenants in the ATSB Loan as noted below. The industry is highly competitive. In order to preserve and enhance its industry position, the

Company continuously reviews its strategies for the use of its assets, including exiting non-performing markets and expansion into new markets, both alone

and with partners, in order to deploy its resources most effectively.

Statements of Cash Flow Discussion

For 2003, the Company's operating activities before reorganization items used net cash of $81 million compared to operating activities for 2002 which

used net cash of $315 million. Included in 2003 cash flow from operating activities is $218 million received from the TSA in connection with the Emergency

Wartime Act. Included in net cash used for operating activities for 2002 is an income tax refund of $169 million received by the Company primarily as a

result of the Job Creation and Worker Assistance Act of 2002, $53 million of compensation received under the Stabilization Act and payments of $188

million of ticket taxes for which remittance was deferred until January 2002 under the Stabilization Act. Operating cash flows for 2003 were adversely

affected by the same factors that adversely affected financial results during 2002 (see discussion in "Results of Operations" above) including depressed

economic conditions and relatively high fuel prices. As a result of filing for bankruptcy in August 2002, the Company received liquidity protection under the

automatic stay provisions of the Bankruptcy Code related to prepetition liabilities. While difficult to quantify, this impacted cash flows from operating

activities favorably after the Petition Date through the Effective Date. For 2001, the Company's operating activities used net cash of $146 million. Operating

cash flows were adversely impacted by the weak economic environment that was prevalent most of the year and the precipitous drop in operating revenues

after September 11th. Operating cash flows in 2001 were favorably impacted by $264 million of grants pursuant to the Stabilization Act and $188 million of

ticket taxes deferrals noted above.

For 2003, net cash used for investing activities was $268 million. Investing activities included cash outflows of $208 million related to capital

expenditures, including $174 million for purchase deposits on future regional jet aircraft deliveries and payments made in connection with the delivery of two

regional jets with the balance related to rotables, ground equipment and miscellaneous assets. Increase in short-term investments reflects activity required to

increase returns on the Company's higher cash balances. Increase in restricted cash reflects additional collateral deposits related to the Company's third party

credit card processor, workers' compensation insurance provider and fuel hedging program, partially offset by lower balances in trust accounts (see below).

The Company also received proceeds of $237 million from US Airways Group (upon its receipt of proceeds from the RSA Investment Agreement) which

were used to pay down two intercompany loans then outstanding from US Airways Group.

32