US Airways 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

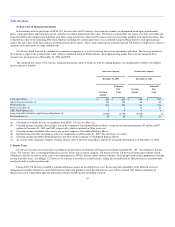

other comprehensive income until the hedged fuel is recognized into earnings. However, to the extent that the absolute change in the value of the fuel hedge

contract exceeds the absolute change in the value of the aircraft fuel purchase being hedged, the difference is considered "ineffective" and is immediately

recognized in earnings as either gain or loss. The amount recognized in earnings may reverse in following periods if the relationship reverses. The fuel hedge

contracts gains and losses including those classified as "ineffective" are recognized to Aviation fuel on US Airways' Consolidated Statements of Operations,

except for those related to hedging purchases of aviation fuel under its capacity purchase agreements, which are recorded to US Airways Express capacity

purchases.

US Airways holds stock options in Sabre Holding Corporation (Sabre) and warrants in a number of e-commerce companies as a result of service

agreements with them. Upon adoption of SFAS 133 on January 1, 2001, US Airways recorded the fair market value of its stock options and warrants, which

was approximately $12 million, on its Consolidated Balance Sheet. The offset was a $7 million credit, net of income taxes, recorded to Cumulative Effect of

Accounting Change on US Airways' Consolidated Statement of Operations. On an ongoing basis, US Airways adjusts its balance sheet to reflect changes in

the current fair market value of the stock options and warrants to Other, net on its Consolidated Statements of Operations. See Note 4 for more information on

US Airways' derivative financial instruments.

(k) Deferred gains and credits, net

In connection with fresh-start reporting, aircraft operating leases were adjusted to fair value. The present value of the difference between the contractual

lease rates and the fair market value rates has been recorded as a deferred credit in the accompanying Consolidated Balance Sheet. The deferred credit is

decreased on a straight-line basis as a reduction in aircraft rent expense over the applicable lease periods, generally three to 21 years. In periods prior to the

adoption of fresh-start reporting, gains on aircraft sale and leaseback transactions were deferred and amortized over the terms of the leases as a reduction of

the related aircraft rent expense.

The gain related to the exercise of Sabre options is deferred and amortized over the contract period as a reduction to Other operating expenses. See Note

4 for more information concerning the Sabre options.

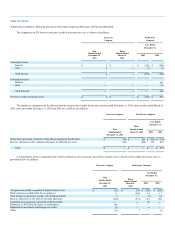

(l) Passenger transportation revenues

Revenue is recognized when the transportation service is rendered. Passenger ticket sales are recorded as a liability (Traffic balances payable and

unused tickets) and subsequently relieved either through carriage of the passenger, refund to the passenger, expiration of the passenger ticket or billing from

another air carrier which provided the service. Due to various factors including refunds, exchanges, unused tickets and transactions involving other carriers,

certain amounts are recorded based on estimates. These estimates are based upon historical experience and have been consistently applied to record revenue.

The Company routinely performs evaluations of the liability which may result in adjustments which are recognized as a component of Passenger

transportation revenue. Actual refund, exchange and expiration activity may vary from estimated amounts. The Company has experienced changes in

customer travel patterns resulting from various factors, including new airport security measures, concerns about further terrorist attacks and an uncertain

economy, resulting in more forfeited tickets and fewer refunds. Therefore, during the fourth quarter of 2003, a $34 million favorable adjustment was made to

Passenger transportation revenue to reflect an increase in expired tickets.

US Airways purchases all of the capacity (available seat miles) generated by US Airways Group's wholly owned regional air carriers and the capacity

of Mesa Airlines, Inc. (Mesa), Chautauqua Airlines, Inc. (Chautauqua) and Trans States Airlines, Inc. (Trans States) in certain markets. US Airways also

purchased the capacity of Midway Airlines Corporation (Midway) prior

60