US Airways 2003 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Financial Accounting Standards No. 88, "Employers' Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and for

Termination Benefits." In 2002, US Airways recognized a curtailment related to the furlough of certain employees.

The accumulated benefit obligation for defined benefit pension plans was $2.53 billion and $4.74 billion as of September 30, 2003 and 2002.

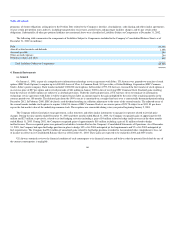

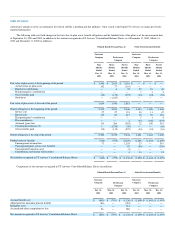

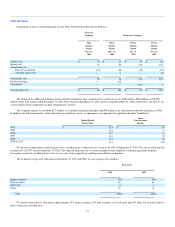

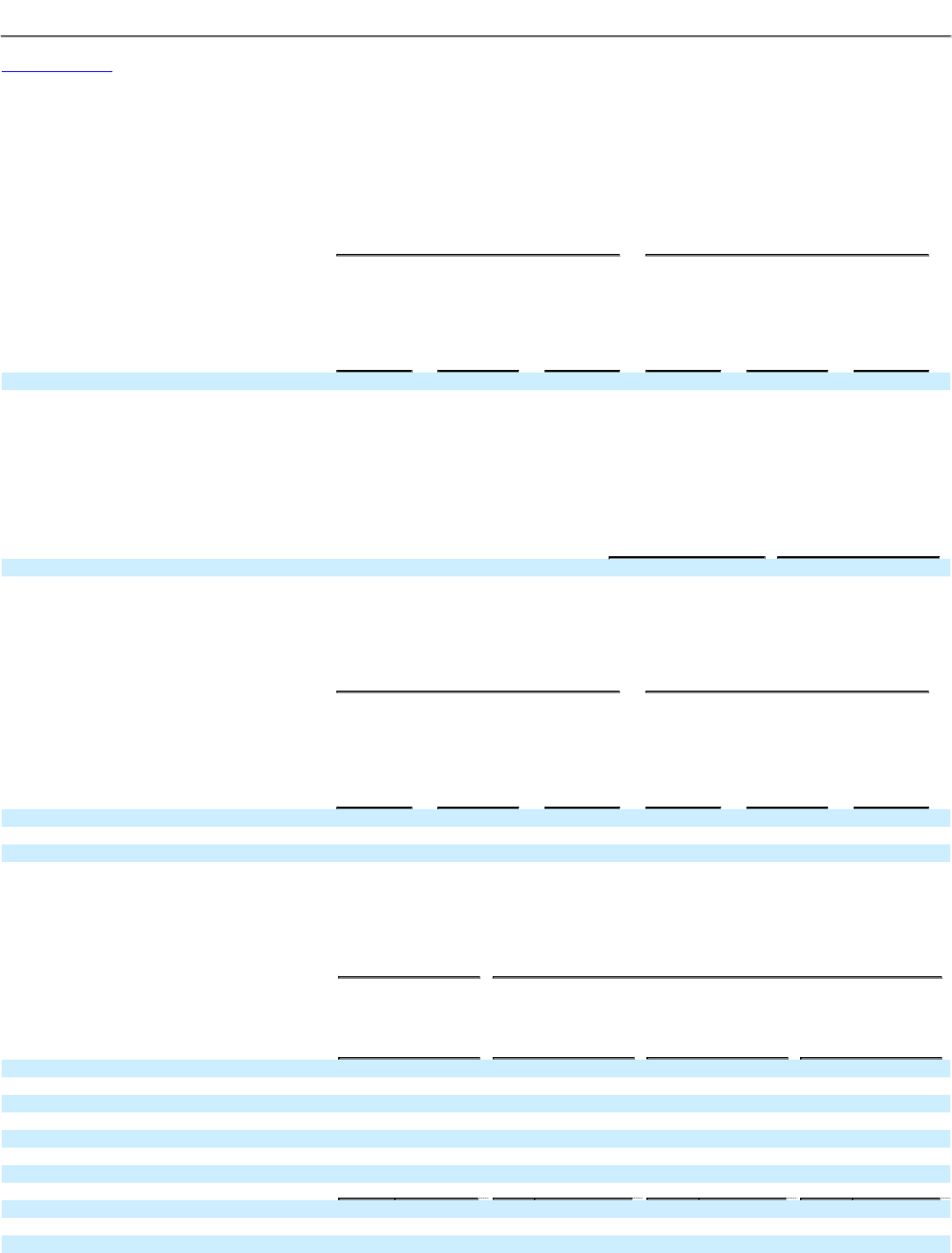

The following table presents the weighted average assumptions used to determine benefit obligations:

Defined Benefit Pension Plans

Other Postretirement Benefits

Nine

Months

Ended

Dec. 31,

2003

Three

Months

Ended

Mar. 31,

2003

Twelve

Months

Ended

Dec. 31,

2002

Nine

Months

Ended

Dec. 31,

2003

Three

Months

Ended

Mar. 31,

2003

Twelve

Months

Ended

Dec. 31,

2002

Discount rate 6.00% 6.50% 6.75% 6.00% 6.50% 6.75%

Rate of compensation increase 3.73% 3.73% 5.43% — — 5.37%

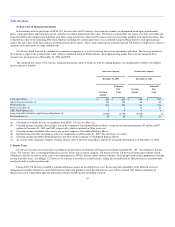

The assumed health care cost trend rates are 9% in 2004 and 2005, decreasing to 5% in 2009, and thereafter. This compares to a health care cost trend

rate of 10% in 2003 decreasing to 5% in 2008 and thereafter. The assumed health care cost trend rates have a significant effect on amounts reported for retiree

health care plans. A one-percentage point change in the health care cost trend rates would have the following effects on Other Postretirement Benefits as of

September 30, 2003 (in millions):

1% Increase

1% Decrease

Effect on total service and interest costs $ 27 $ (21)

Effect on postretirement benefit obligation $ 258 $ (203)

Weighted average assumptions used to determine net periodic benefit cost were as follows:

Defined Benefit Pension Plans

Other Postretirement Benefits

Nine

Months

Ended

Dec. 31,

2003

Three

Months

Ended

Mar. 31,

2003

Twelve

Months

Ended

Dec. 31,

2002

Nine

Months

Ended

Dec. 31,

2003

Three

Months

Ended

Mar. 31,

2003

Twelve

Months

Ended

Dec. 31,

2002

Discount rate 6.50% 6.75% 7.50% 6.50% 6.75% 7.50%

Expected return on plan assets 8.00% 8.75% 9.50% — — —

Rate of compensation increase 3.73% 5.41% 6.42% — — 5.86%

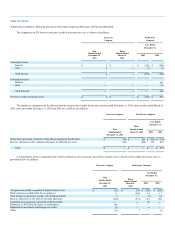

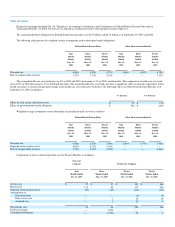

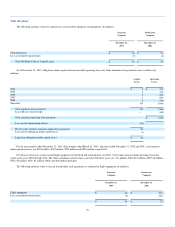

Components of the net and total periodic cost for Pension Benefits (in millions):

Successor

Company

Predecessor Company

Nine

Months Ended

Dec. 31, 2003

Three

Months Ended

Mar. 31, 2003

Twelve

Months Ended

Dec. 31, 2002

Twelve

Months Ended

Dec. 31, 2001

Service cost $ 27 $ 27 $ 191 $ 160

Interest cost 113 89 417 344

Expected return on plan assets (89) (69) (330) (317)

Amortization of:

Transition asset — — (4) (5)

Prior service cost — 1 10 10

Actuarial loss — 1 39 4

Net periodic cost 51 49 323 196

Fresh start charge — 1,004 — —

Curtailment/settlement — (1,391) 42 2