US Airways 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

special items and Government compensation.

Other Income (Expense)–Interest income decreased due to lower average investment balances and return rates. Interest expense increased due to the higher

level of debt outstanding. Refer to "Description of Unusual Items" below for information on Reorganization items, net and Merger termination fee.

Provision (Credit) for Income Taxes–During 2001, the Company recognized a valuation allowance against its net deferred tax asset. As a result of the March

2002 enactment of the Job Act, the Company recognized an income tax credit equal to the Company's carryback potential. The tax credit recorded in 2002

includes $53 million related to 2001 losses realizable due to the enactment of the Job Act and recorded in the period of enactment. The Company continued to

record a valuation allowance against its net deferred tax asset which resulted in a 2002 effective tax rate of 13%. The effective tax rate was 33% for the first

six months of 2001 after which the Company recorded a valuation allowance which resulted in an effective tax rate of 12%. The tax credit for the first six

months of 2001 results from the tax benefits associated with the pretax losses offset by the tax effects of the Company's permanent tax differences.

Selected Operating and Financial Statistics–System capacity (as measured by ASMs) decreased 13.1% and passenger volume (as measured by RPMs)

decreased 10.9% in 2002. These decreases resulted in a 69.6% system passenger load factor, representing a 1.7 percentage point increase over 2001. Full year

comparisons are rendered less meaningful due to the events of September 11th. US Airways was one of the airlines most significantly affected by the events of

September 11th. Not only were US Airways' operations shut down entirely for three days in September, but Reagan National, at which US Airways is the

largest carrier, was closed until October 4, 2001. Service was not fully restored there until May 2002. In addition, the Company made very significant

schedule changes as a result of the conditions after September 11th. System yield decreased 6.5% for 2002 reflecting fewer high-yield ticket sales (i.e.

business sales) and heavy price discounting used to stimulate the industry-wide soft demand related to the sluggish economic conditions as well as the threat

of war in Iraq and further terrorist attacks.

Description of Unusual Items

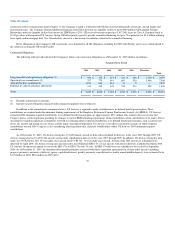

Asset Impairments and Other Special Items–Asset impairments and other special items included within the Company's Consolidated Statements of Operations

includes the following components (dollars in millions):

Successor

Company

Predecessor Company

Nine

Months Ended

December 31,

2003

Year Ended

December 31,

2002

2001

Aircraft order cancellation penalty $ 35 (a) $ — $ —

Aircraft impairments and related charges — 392 (b) 787(f)

Pension and postretirement benefit curtailments — (90)(c) 2(c)

Employee severance including benefits (1)(d) (3)(d) 83(d)

Future aircraft lease commitments — — 70(e)

Other — 21 (g) 16(g)

$ 34 $ 320 $ 958

(a) During the quarter ended June 30, 2003, the Company recorded a $35 million charge in connection with its intention not to take delivery of certain

aircraft scheduled for future delivery.

(b) During the fourth quarter of 2002, US Airways conducted an impairment analysis in accordance with Statement of Financial Accounting Standards No.

144, "Accounting for the Impairment or Disposal of Long-Lived Assets"

27