US Airways 2003 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

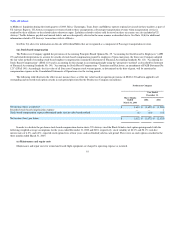

Table of Contents

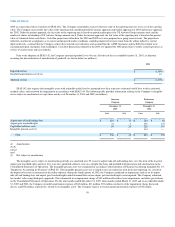

Predecessor

Company

Debt

Discharge (a)

Emergence

Financings (b)

Fresh-start

Adjustments (c)

Successor

Company

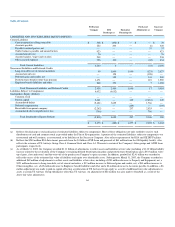

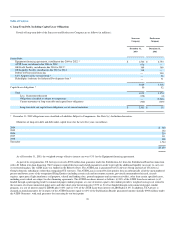

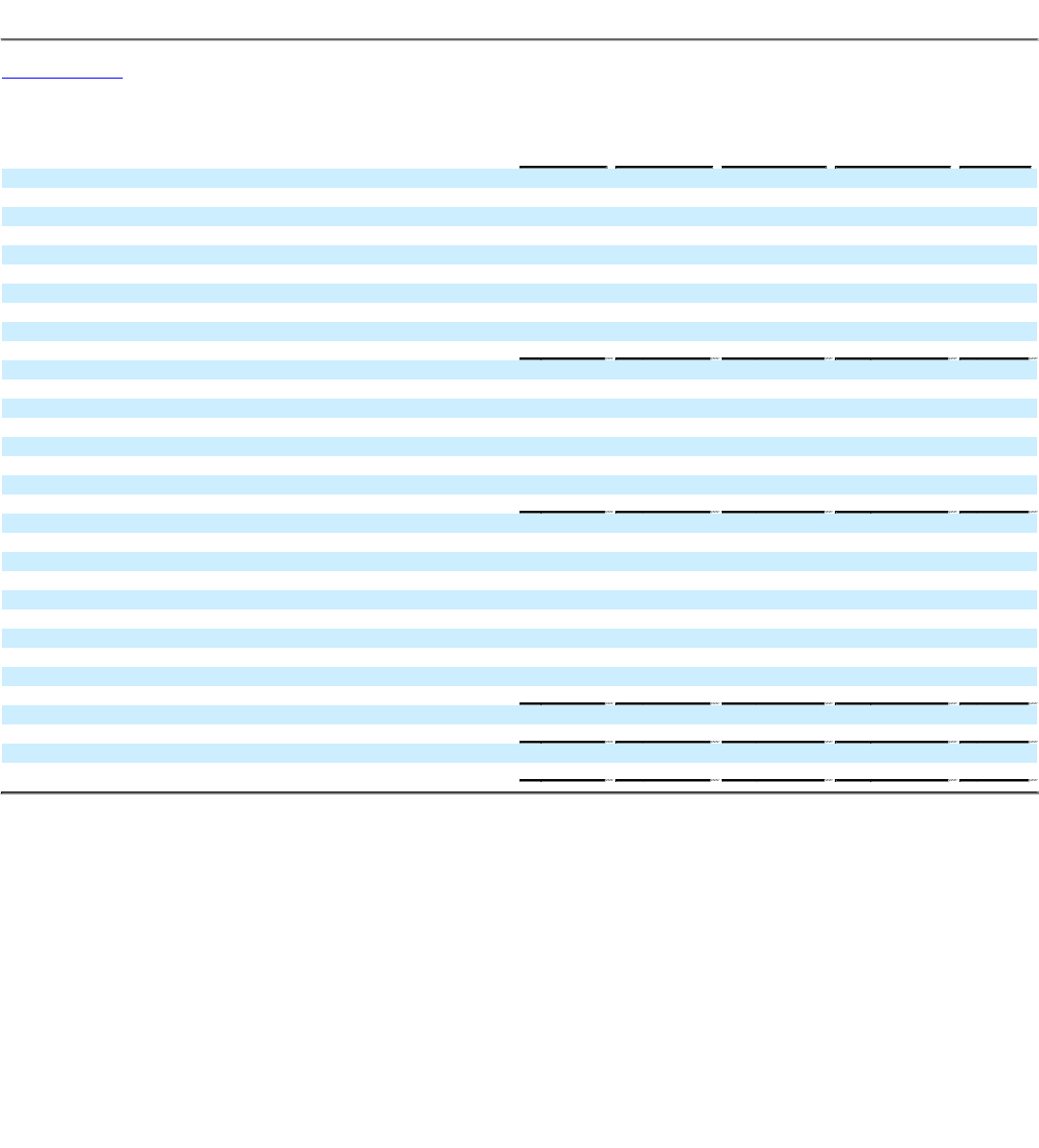

LIABILITIES AND STOCKHOLDER'S EQUITY (DEFICIT)

Current Liabilities

Current maturities of long-term debt $ 368 $ (298) $ — $ — $ 70

Accounts payable 222 204 — (6) 420

Payable to related parties, net — — — 37 37

Traffic balances payable and unused tickets 923 — — — 923

Accrued aircraft rent 76 — — — 76

Accrued salaries, wages and vacation 238 — — — 238

Other accrued expenses 396 100 — (62) 434

Total Current Liabilities 2,223 6 — (31) 2,198

Noncurrent Liabilities and Deferred Credits

Long-term debt, net of current maturities 99 1,809 1,040 (121) 2,827

Accrued aircraft rent — 128 — (128) —

Deferred gains and credits, net — 359 — 141 500

Postretirement benefits other than pensions 1,471 — — 118 1,589

Employee benefit liabilities and other 868 193 — 7 1,068

Total Noncurrent Liabilities and Deferred Credits 2,438 2,489 1,040 17 5,984

Liabilities Subject to Compromise 6,632 (6,632) — — —

Stockholder's Equity (Deficit)

Common stock — — — — —

Paid-in capital 2,661 — 169 (2,481) 349

Accumulated deficit (5,421) 3,655 — 1,766 —

Deferred compensation — — (169) — (169)

Receivable from parent company (2,262) — 237 2,025 —

Accumulated other comprehensive loss (796) — — 796 —

Total Stockholder's Equity (Deficit) (5,818) 3,655 237 2,106 180

$ 5,475 $ (482) $ 1,277 $ 2,092 $ 8,362

(a) Reflects the discharge or reclassification of estimated liabilities subject to compromise. Most of these obligations are only entitled to receive such

distributions of cash and common stock as provided under the Plan of Reorganization. A portion of the estimated liabilities subject to compromise was

restructured and will continue, as restructured, to be liabilities of the Successor Company. Also reflects repayment of the RSA and GE DIP Facilities.

(b) Reflects the $240 million RSA Investment, proceeds from the $1 billion ATSB Loan and proceeds of $63 million from the GE liquidity facility. Also

reflects the issuance of US Airways Group Class A Common Stock and Class A-1 Warrants to certain of the Company's labor groups and ATSB Loan

participants, respectively.

(c) As of March 31, 2003, the Company recorded $1.11 billion of adjustments to reflect assets and liabilities at fair value (including a $1.12 billion liability

increase related to the revaluation of the Company's remaining defined benefit pension plans and postretirement benefit plans and a $333 million write-

up of gates, slots and routes) and the write-off of the predecessor Company's equity accounts. In addition, goodwill of $2.41 billion was recorded to

reflect the excess of the estimated fair value of liabilities and equity over identifiable assets. Subsequent to March 31, 2003, the Company recorded an

additional $62 million of adjustments to reflect assets and liabilities at fair value, including a $281 million decrease to Property and Equipment, net, a

$121 million decrease to Long-term debt, net of current maturities, a $13 million increase to Deferred gains and credits, net, a $54 million increase to

Other intangibles, net, a $15 million decrease to Employee benefit liabilities and other and a $6 million decrease to Accounts payable. In addition, a $6

million adjustment was made to paid-in capital reflecting a reallocation of US Airways Group equity as a result of additional fair value adjustments to

assets at certain US Airways Group subsidiaries other than US Airways. An adjustment of $62 million was also made to Goodwill as a result of the

above fair value adjustments.

64