US Airways 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Impairment of Long-Lived Assets and Intangible Assets Subject to Amortization

The Company assesses the impairment of long-lived assets and intangible assets subject to amortization whenever events or changes in circumstances

indicate that the carrying value may not be recoverable. Factors which could trigger an impairment review include the following: significant changes in the

manner of use of the assets; significant underperformance relative to historical or projected future operating results; or significant negative industry or

economic trends. The Company determines that an impairment has occurred when the future undiscounted cash flows estimated to be generated by those

assets are less than the carrying amount of those items. Cash flow estimates are based on historical results adjusted to reflect the Company's best estimate of

future market and operating conditions. The net carrying value of assets not recoverable is reduced to fair value. Estimates of fair value represent the

Company's best estimate based on appraisals, industry trends and reference to market rates and transactions. Changes in industry capacity and demand for air

transportation can significantly impact the fair value of aircraft and related assets. Refer to "Description of Unusual Items" above for details regarding

impairment charges recognized in 2002 and 2001.

Pensions and Other Postretirement Benefits

The Company accounts for its defined benefit pension plans using Statement of Financial Accounting Standards No. 87, "Employer's Accounting for

Pensions" (SFAS 87) and its other postretirement benefit plans using Statement of Financial Accounting Standards No. 106, "Employer's Accounting for

Postretirement Benefits Other than Pensions" (SFAS 106). Under both SFAS 87 and SFAS 106, expense is recognized on an accrual basis over employees'

approximate service periods. Expenses calculated under SFAS 87 and SFAS 106 are generally independent of funding decisions or requirements. Exclusive of

fresh-start charges, curtailment and settlement items, the Company recognized defined benefit pension plan expense of $51 million, $49 million, $323 million

and $196 million for the nine months ended December 31, 2003, three months ended March 31, 2003 and years 2002 and 2001, respectively, and other

postretirement benefit expense of $96 million, $36 million, $145 million and $127 million for the nine months ended December 31, 2003, three months ended

March 31, 2003 and years ended December 31, 2002 and 2001, respectively.

The calculation of pension and other postretirement benefit expenses and liabilities requires the use of a number of assumptions. Changes in these

assumptions can result in different expense and liability amounts, and future actual experience can differ from the assumptions. The Company believes that

the two most critical assumptions for pension plans are the expected long-term rate of return on plan assets and the assumed discount rate, and for other

postretirement benefit plans are the assumed discount rate and the assumed health care trend rate.

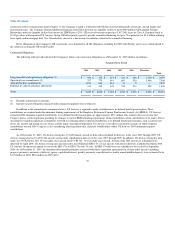

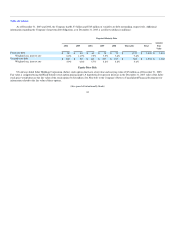

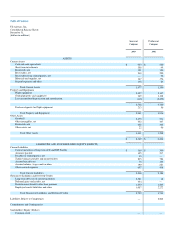

US Airways assumed that its pension plans' assets would generate a long-term rate of return of 8.00% at September 30, 2003, its measurement date for

most of its pension plans. This rate is lower than the assumed rate of 8.75% used at September 30, 2002. The expected long-term rate of return assumption is

developed by evaluating input from the plan's investment consultants, including their review of asset class return expectations and long-term inflation

assumptions. The expected long-term rate of return on plan assets was based on a target allocation of assets to the following fund types:

Percent of Total

Expected Long-Term Rate of Return

Equity securities 35% 9%

Debt securities 45 6%

Real estate 10 8%

Other 10 12%

Total 100%

40