US Airways 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

2002 (in connection with its transition to SFAS 142). The Company concluded in each test that fair value of the reporting unit was in excess of the carrying

value. The Company assessed the fair value of the reporting unit considering both the income approach and market approach for 2003 and income approach

for 2002. Under the market approach, the fair value of the reporting unit is based on quoted market prices for US Airways Group common stock and the

number of shares outstanding of US Airways Group common stock. Under the income approach, the fair value of the reporting unit is based on the present

value of estimated future cash flows. Cash flow projections utilized for the 2003 and 2002 tests were prepared on a going-concern basis. The projections

reflected a number of assumptions as to current and projected market conditions, including improved revenue trends from the airline industry's current

depressed levels, assumed that the Company achieved its targeted cost reductions and assumed that the ATSB Guarantee and the RSA Investment were

consummated upon emergence from bankruptcy. Cash flow projections utilized for the 2003 test updated the 2002 projections to reflect actual experience as

well as revised revenue and cost outlooks.

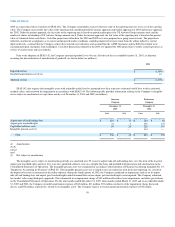

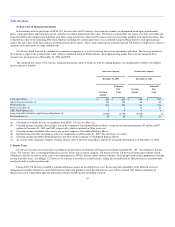

Prior to the adoption of SFAS 142, the Company amortized goodwill over 40 years. Results for the year ended December 31, 2001, as adjusted,

assuming the discontinuation of amortization of goodwill, are shown below (in millions):

2001

Reported net loss $ (1,989)

Goodwill amortization, net of tax 19

Adjusted net loss $ (1,970)

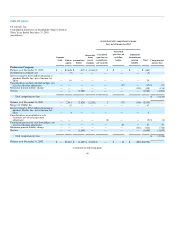

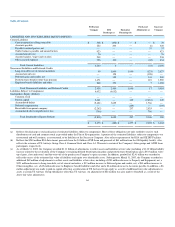

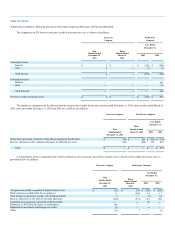

SFAS 142 also requires that intangible assets with estimable useful lives be amortized over their respective estimated useful lives to their estimated

residual values, and reviewed for impairments in accordance with SFAS 144. The following table provides information relating to the Company's intangible

assets subject to amortization (except where noted) as of December 31, 2003 and 2002 (in millions):

Successor

Company

Predecessor

Company

December 31,

2003

December 31,

2002

Cost

A/A

Cost

A/A

Airport take-off and landing slots $ 424 $ 13 $ 184 $ 62

Airport gate leasehold rights 32 4 165 147

Capitalized software costs 50 26 220 167

Intangible pension asset (1) — — 114 —

Total $ 506 $ 43 $ 683 $ 376

A/

A=Ac

cumul

ated

Amortization

(1) Not subject to amortization.

The intangible assets subject to amortization generally are amortized over 25 years for airport take-off and landing slots, over the term of the lease for

airport gate leasehold rights and over five years for capitalized software costs on a straight-line basis and included in Depreciation and amortization on the

Consolidated Statements of Operations. The intangible pension asset was recognized in accordance with Statement of Financial Accounting Standards No. 87,

"Employers' Accounting for Pensions" (SFAS 87). The intangible pension asset was revalued to zero in connection with fresh-start reporting. As a result of

the depressed revenue environment in the airline industry, during the fourth quarter of 2002, the Company conducted an impairment analysis of its airport

take-off and landing slots and airport gate leasehold rights and determined that certain airport gate leasehold rights were impaired. The Company estimated

fair market value using third-party appraisals. This culminated in an impairment charge of $21 million reflected in Asset impairments and other special items

on the Consolidated Statement of Operations. For the nine months ended December 31, 2003, three months ended March 31, 2003 and years ended December

31, 2002 and 2001, the Company recorded amortization expense of $43 million, $11 million, $51 million (exclusive of the impairment charge discussed

above), and $56 million, respectively, related to its intangible assets. The Company expects to record annual amortization expense of $34 million

58