US Airways 2003 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

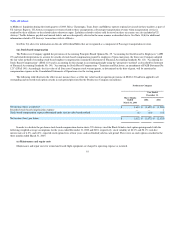

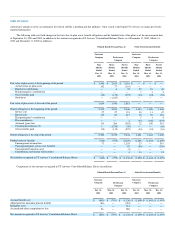

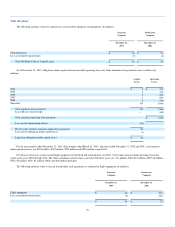

6. Long-Term Debt, Including Capital Lease Obligations

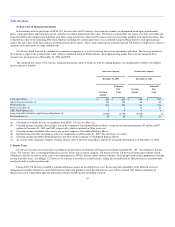

Details of long-term debt of the Successor and Predecessor Company are as follows (in millions):

Successor

Company

Predecessor

Company

December 31,

2003

December 31,

2002

Senior Debt:

Equipment financing agreements, installments due 2004 to 2022 * $ 1,546 $ 2,750

ATSB Loan, installments due 2006 to 2009 976 —

GE Credit Facility, installments due 2004 to 2012 * 389 369

GE Liquidity Facility, installments due 2010 to 2012 118 —

Debtor-in-Possession financing — 300

8.6% Airport facility revenue bond * — 28

Philadelphia Authority for Industrial Development loan * — 71

3,029 3,518

Capital lease obligations * 50 52

Total 3,079 3,570

Less: Unamortized discount (138) (4)

Obligations classified as subject to compromise — (3,248)

Current maturities of long-term debt and capital lease obligations (360) (300)

Long-term debt and capital lease obligations, net of current maturities $ 2,581 $ 18

* December 31, 2002 obligations were classified as Liabilities Subject to Compromise. See Note 3(c) for further discussion.

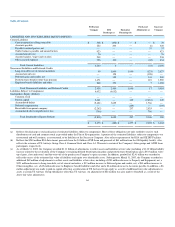

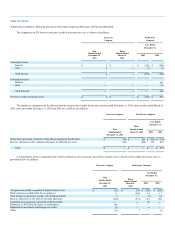

Maturities of long-term debt and debt under capital leases for the next five years (in millions):

2004 $ 360

2005 142

2006 214

2007 311

2008 308

Thereafter 1,744

$3,079

As of December 31, 2003, the weighted average effective interest rate was 9.3% for the Equipment financing agreements.

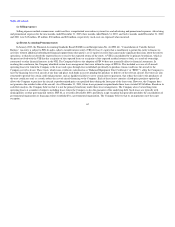

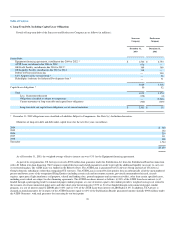

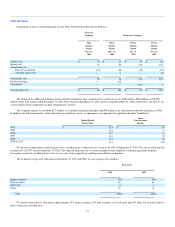

As part of its reorganization, US Airways received a $900 million loan guarantee under the Stabilization Act from the Stabilization Board in connection

with a $1 billion term loan financing. The Company required this loan and related guarantee in order to provide the additional liquidity necessary to carry out

its restructuring plan. The ATSB Loan was funded on the Effective Date. The ATSB Loan is guaranteed by US Airways Group and each of US Airways

Group's domestic subsidiaries (other than reorganized US Airways). The ATSB Loan is secured by first priority liens on substantially all of the unencumbered

present and future assets of the reorganized Filing Entities (including certain cash and investment accounts, previously unencumbered aircraft, aircraft

engines, spare parts, flight simulators, real property, takeoff and landing slots, ground equipment and accounts receivable), other than certain specified assets,

including assets which are subject to other financing agreements. The ATSB Loan bears interest as follows: (i) 90% of the ATSB Loan bears interest (a) if

funded through a participating lender's commercial paper conduit program, at a rate of interest equal to the conduit provider's weighted average cost related to

the issuance of certain commercial paper notes and other short-term borrowings plus 0.30% or (b) if not funded through such commercial paper conduit

program, at a rate of interest equal to LIBOR plus 0.40% and (ii) 10% of the ATSB Loan bears interest at LIBOR plus 4.0%. In addition, US Airways is

charged an annual guarantee fee in respect of the ATSB Guarantee equal to 4.0% of the Stabilization Board's guaranteed amount (initially $900 million) under

the ATSB Guarantee, with such guarantee fee increasing by ten basis points

70