US Airways 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

to Midway's liquidation during the fourth quarter of 2003. Mesa, Chautauqua, Trans States and Midway operate regional jet aircraft in these markets as part of

US Airways Express. US Airways recognizes revenues related to these arrangements as Passenger transportation revenue when transportation service is

rendered by these affiliates or the related tickets otherwise expire. Liabilities related to tickets sold for travel on these air carriers are also included in US

Airways' Traffic balances payable and unused tickets and are subsequently relieved in the same manner as described above. See Note 13(b) for additional

information related to US Airways' transactions with its affiliates.

See Note 2(i) above for information on the sale of Dividend Miles that are recognized as a component of Passenger transportation revenue.

(m) Stock-based compensation

The Predecessor Company applied the provisions of Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees" (APB

25) and related interpretations to account for awards of stock-based compensation granted to employees. Upon emergence, the Successor Company adopted

the fair value method of recording stock-based employee compensation contained in Statement of Financial Accounting Standards No. 123, "Accounting for

Stock-Based Compensation" (SFAS 123) and is accounting for this change in accounting principle using the "prospective method" as described by Statement

of Financial Accounting Standards No. 148, "Accounting for Stock-Based Compensation – Transition and Disclosure, an amendment of FASB Statement No.

123" (SFAS 148). Accordingly, the fair value of all Successor Company stock warrant grants, as determined on the date of grant, will be amortized as

compensation expense in the Consolidated Statements of Operations over the vesting period.

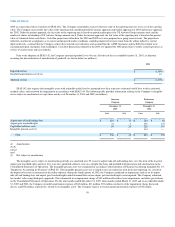

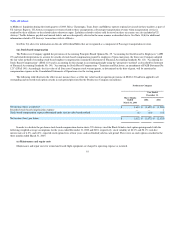

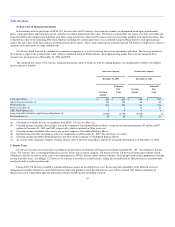

The following table illustrates the effect on net income (loss) as if the fair value based recognition provisions of SFAS 123 had been applied to all

outstanding and unvested stock option awards in each period presented for the Predecessor Company (in millions).

Predecessor Company

Three Months

Ended

March 31, 2003

Year Ended

December 31,

2002

2001

Net income (loss), as reported $ 1,613 $ (1,659) $ (1,989)

Recorded stock-based compensation expense — — 1

Stock-based compensation expense determined under the fair value based method (1) (13) (37)

Net income (loss), pro forma $ 1,612 $ (1,672) $ (2,025)

In order to calculate the pro forma stock-based compensation shown above, US Airways used the Black-Scholes stock option pricing model with the

following weighted-average assumptions for the years ended December 31, 2002 and 2001, respectively: stock volatility of 80.1% and 58.1%; risk-free

interest rates of 4.2%, and 4.6%; expected stock option lives of four years; and no dividend yield in each period. There were no stock options awarded in the

three months ended March 31, 2003.

(n) Maintenance and repair costs

Maintenance and repair costs for owned and leased flight equipment are charged to operating expense as incurred.

61