US Airways 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(f) Concentration of credit risk

US Airways invests available cash in money market securities of various banks, commercial paper and asset-backed securities of various financial

institutions, other companies with high credit ratings and securities backed by the U.S. Government.

As of December 31, 2003, most of US Airways' receivables related to tickets sold to individual passengers through the use of major credit cards or to

tickets sold by other airlines and used by passengers on US Airways or its regional airline affiliates. These receivables are short-term, mostly being settled

within seven days after sale. Bad debt losses, which have been minimal in the past, have been considered in establishing allowances for doubtful accounts.

US Airways does not believe it is subject to any significant concentration of credit risk.

9. Stockholder's Equity and Dividend Restrictions

(a) Common stock and dividend restrictions

US Airways Group owns all of US Airways' outstanding common stock, par value $1 per share. US Airways' board of directors has not authorized the

payment of dividends on the common stock since 1988.

US Airways, organized under the laws of the State of Delaware, is subject to Sections 160 and 170 of the Delaware General Corporation Law with

respect to the payment of dividends on or the repurchase or redemption of its capital stock. US Airways is restricted from engaging in any of these activities

unless it maintains a capital surplus. In addition, US Airways may not pay dividends in accordance with provisions contained in the ATSB Loan.

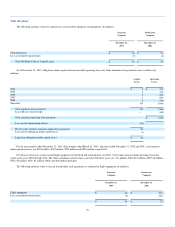

(b) Receivable from parent company

See Note 13(a).

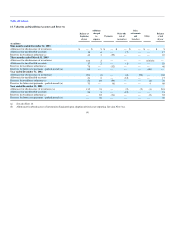

(c) Distributions to affiliate, net

In May 1999, US Airways Group created USLM Corporation (USLM) to more efficiently manage its postretirement medical, dental and life insurance

benefits for employees who had retired or were eligible for retirement as of January 1, 1998 from US Airways. Effective July 1, 2002, USLM Corporation

merged into US Airways.

Prior to the merger, USLM paid a portion of the postretirement benefit liabilities on behalf of US Airways. However, US Airways continued to record

all postretirement benefit liabilities and related expenses in its consolidated financial statements. In connection with this arrangement, US Airways had note

payables of $558 million and $16 million, each bearing interest at 8.25%, to fund USLM operations. During 2002 and 2001, US Airways paid interest of $24

million and $48 million, respectively, to USLM of which $24 million and $41 million, respectively, was used to reduce US Airways' liabilities for this

population of retirees.

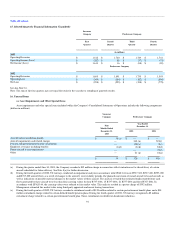

10. Stock-Based Compensation

(a) Successor Company

Upon emergence, the Successor Company adopted the fair value method of recording stock-based employee compensation contained in SFAS 123 and

is accounting for this change in accounting principle using the "prospective method" as described by SFAS 148. Accordingly, the fair value of all Successor

Company warrant grants, as determined on the date of grant, will be

84