US Airways 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

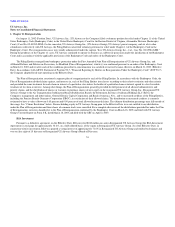

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

The Company's primary market risk exposures include commodity price risk (i.e. the price paid to obtain aviation fuel), interest rate risk and equity

price risk. The potential impact of adverse increases in the aforementioned risks and general strategies employed by the Company to manage such risks are

discussed below.

The following sensitivity analyses do not consider the effects that an adverse change may have on the overall economy nor do they consider additional

actions the Company may take to mitigate its exposure to such changes. Actual results of changes in prices or rates may differ materially from the following

hypothetical results.

Commodity Price Risk

Aviation fuel is typically the Company's second largest expense. Prices and availability of all petroleum products are subject to political, economic and

market factors that are generally outside of the Company's control. Accordingly, the price and availability of aviation fuel, as well as other petroleum

products, can be unpredictable. Prices may be affected by many factors, including: the impact of political instability on crude production, especially in Russia

and OPEC countries; unexpected changes to the availability of petroleum products due to disruptions in distribution systems or refineries; unpredicted

increases to oil demand due to weather or the pace of economic growth; inventory levels of crude, refined products and natural gas; and other factors, such as

the relative fluctuation between the U.S. dollar and other major currencies and influence of speculative positions on the futures exchanges. Because the

operations of the Company are dependent upon aviation fuel, significant increases in aviation fuel costs could materially and adversely affect the Company's

liquidity, results of operations and financial condition.

The Company utilizes financial derivatives, including fixed price swap agreements, collar structures and other similar instruments, to manage some of

the risk associated with changes in aviation fuel prices. As of December 31, 2003, the Company had open fuel hedge positions in place to hedge 30% of its

2004 anticipated jet fuel requirements and 5% of its 2005 anticipated jet fuel requirements. The fair value of these positions was a net asset of approximately

$38 million, which is recorded in Prepaid expenses and other in the Company's Consolidated Balance Sheet. An immediate hypothetical ten percent increase

or decrease in underlying fuel-related commodity prices from the December 31, 2003 prices would change the fair value of the commodity derivative

financial instruments in place by $22 million.

Interest Rate Risk

Exposure to interest rate risk relates primarily to the Company's cash equivalents and short-term investments portfolios and long-term debt obligations.

As long as the Company maintains or improves its cash and short-term investment balance, it is effectively self-hedged against changes in interest rates with

regard to its floating rate debt.

As noted in "Contractual Obligations" above, US Airways Group has future aircraft purchase commitments of $3.24 billion. It expects to lease or

mortgage a majority of those commitments. Changes in interest rates will impact the cost of such financings.

43