US Airways 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

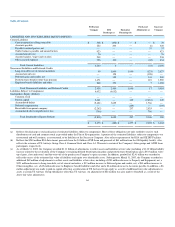

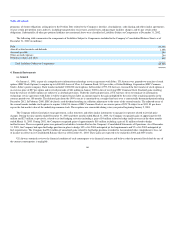

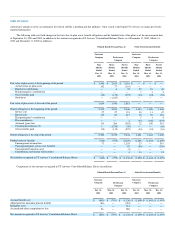

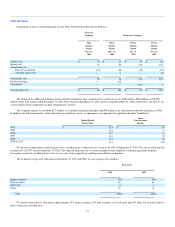

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and liabilities as of December 31, 2003

(Successor Company) and December 31, 2002 (Predecessor Company) are as follows (in millions):

2003

2002

Deferred tax assets:

Employee benefits $ 1,131 $ 1,164

Leasing transactions 10 199

Sale and leaseback transactions — 167

Other deferred tax assets 179 225

Net operating loss carryforwards 40 100

Federal general business and foreign tax credit carryforwards 5 24

AMT credit carryforward 28 2

Valuation allowance (617) (1,216)

Net deferred tax assets 776 665

Deferred tax liabilities:

Depreciation and amortization 622 648

Sale and leaseback transactions 82 —

Other deferred tax liabilities 72 17

Total deferred tax liabilities 776 665

Net deferred tax assets $ — $ —

Included in the employee benefit deferred tax assets at December 31, 2003 and 2002, among other items, are $630 million and $565 million,

respectively, related to obligations of postretirement medical benefits.

As of December 31, 2003, US Airways had a $53 million federal net operating loss carryforward expiring in 2022, $5 million of general business tax

credits expiring in 2004, $28 million of alternative minimum tax credits which do not expire, and $1 billion of state net operating loss carryforwards primarily

expiring from 2006 to 2022. The federal and state net operating loss carryforwards were reduced by discharge of indebtedness income of $1.2 billion that

resulted from the bankruptcy proceedings. In addition, an Internal Revenue Code Section 382 change of ownership occurred for US Airways Group upon

issuance of new common stock to creditors. Section 382 will substantially limit the annual usage of the tax attributes that were generated prior to the change

in ownership.

The federal income tax returns of the Company through 2002 have been examined and settled with the Internal Revenue Service. The Company is not

currently under examination.

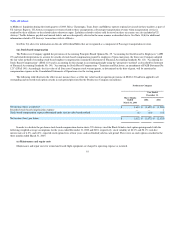

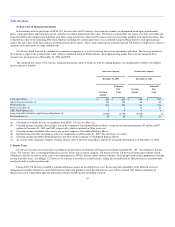

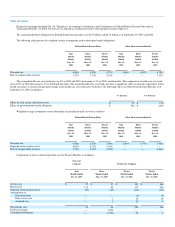

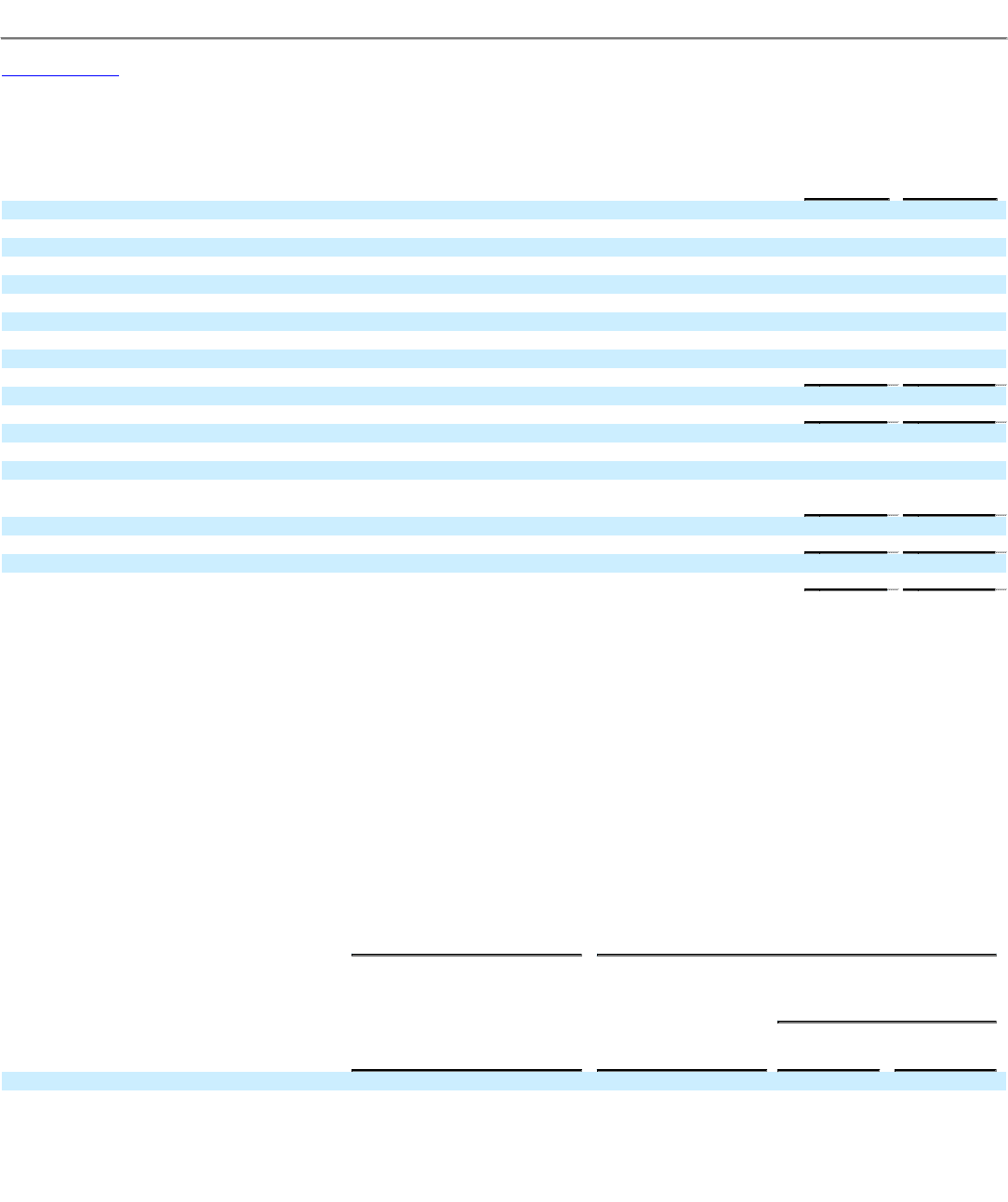

The following table is a summary of pretax book income and taxable income prior to net operating loss carryforwards/carrybacks for the nine months

ended December 31, 2003, three months ended March 31, 2003, and years ended December 31, 2002 and 2001 (in millions):

Successor Company

Predecessor Company

Nine

Months Ended

December 31,

2003

Three

Months Ended

March 31,

2003

Year Ended

December 31,

2002

2001

Pretax book income (loss) $ (154) $ 1,613 $ (1,914) $ (1,787)

Taxable income (loss) $ 149 $ 262 $ (1,102) $ (894)

The reasons for significant differences between taxable income and pretax book income primarily relate to discharge of indebtedness income,

bankruptcy-related charges, employee pension and postretirement benefit costs, employee-related accruals and leasing transactions.

69