US Airways 2003 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

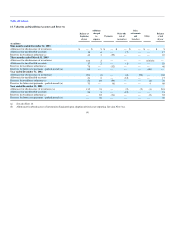

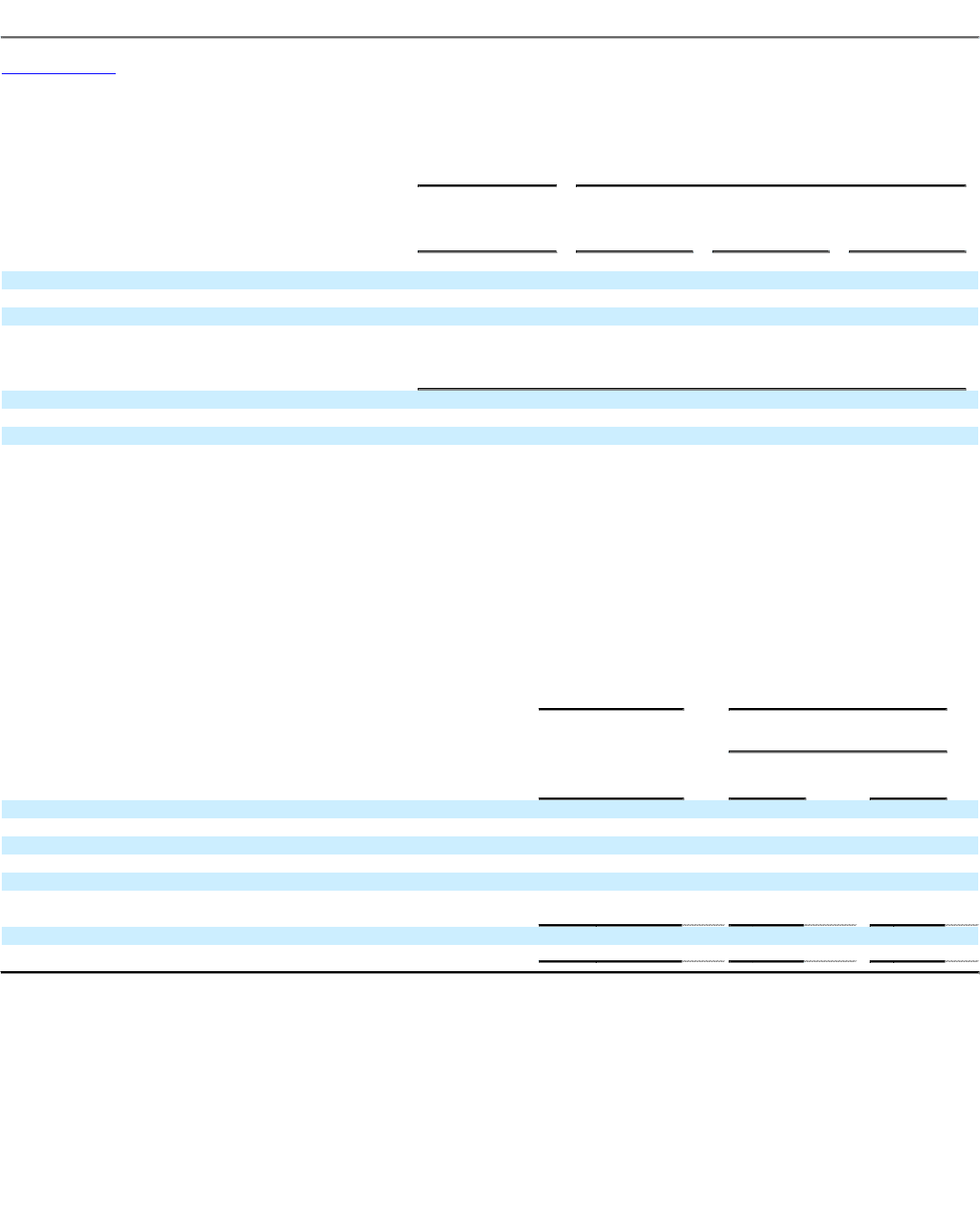

15. Selected Quarterly Financial Information (Unaudited)

Successor

Company

Predecessor Company

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

(in millions)

2003

Operating Revenues $ 1,512 $ 1,760 $ 1,749 $ 1,741

Operating Income (Loss) $ (202) $ 68 $ (37) $ (73)

Net Income (Loss) $ 1,613 $ 16 $ (88) $ (89)

Predecessor Company

2002

Operating Revenues $ 1,695 $ 1,891 $ 1,735 $ 1,595

Operating Loss $ (369) $ (164) $ (182) $ (606)

Net Loss $ (298) $ (225) $ (358) $ (778)

See also Note 16.

Note: The sum of the four quarters may not equal the totals for the year due to rounding of quarterly results.

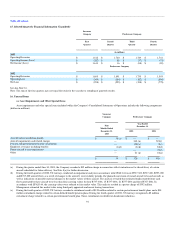

16. Unusual Items

(a) Asset Impairments and Other Special Items

Asset impairments and other special items included within the Company's Consolidated Statements of Operations includes the following components

(dollars in millions):

Successor

Company

Predecessor Company

Nine

Months Ended

December 31,

2003

Year Ended

December 31,

2002

2001

Aircraft order cancellation penalty $ 35 (a) $ — $ —

Aircraft impairments and related charges — 392 (b) 787(f)

Pension and postretirement benefit curtailments — (90)(c) 2(c)

Employee severance including benefits (1)(d) (3)(d) 83(d)

Future aircraft lease commitments — — 70(e)

Other — 21 (g) 16(g)

$ 34 $ 320 $ 958

(a) During the quarter ended June 30, 2003, the Company recorded a $35 million charge in connection with its intention not to take delivery of certain

aircraft scheduled for future delivery. See Note 8(a) for further discussion.

(b) During the fourth quarter of 2002, US Airways conducted an impairment analysis in accordance with SFAS 144 on its B737-300, B737-400, B757-200

and B767-200 aircraft fleets as a result of changes to the aircraft's recoverability periods (the planned conversion of owned aircraft to leased aircraft) as

well as indications of possible material changes to the market values of these aircraft. The analysis revealed that estimated undiscounted future cash

flows generated by these aircraft were less than their carrying values for four B737-300s, 15 B737-400s, 21 B757-200s and three B767-200s. In

accordance with SFAS 144, the carrying values were reduced to fair market value. This analysis resulted in a pretax charge of $392 million.

Management estimated fair market value using third-party appraisals and recent leasing transactions.

(c) During the fourth quarter of 2002, US Airways recorded a curtailment credit of $120 million related to certain postretirement benefit plans and a $30

million curtailment charge related to certain defined benefit pension plans. During the fourth quarter of 2001, US Airways recognized a $2 million

curtailment charge related to a certain postretirement benefit plan. These curtailments resulted from headcount reductions.

91