US Airways 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

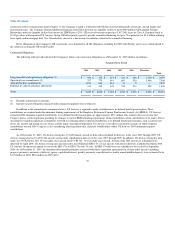

million in 2006, $31 million in 2007 and $2 million in 2008. As a result of the recent regional jet aircraft orders, the Company believes it is probable it will

not take delivery of certain previously ordered narrow-body aircraft and recorded an accrual of $35 million for related penalties during the three months ended

June 30, 2003.

Other

US Airways Group had substantial net operating loss (NOL) carryforwards at December 31, 2002, for federal income tax purposes. However, the NOLs

were reduced at December 31, 2003 by discharge of indebtedness income of $1.2 billion from the bankruptcy. In addition, US Airways Group experienced an

"ownership change" (within the meaning of Internal Revenue Code Section 382) on the Effective Date as a result of the issuance of equity to the claimholders

and RSA pursuant to the Plan of Reorganization. As a result, US Airways Group's ability to use NOLs or other tax attributes that remain after the offset of

discharge of indebtedness income is limited.

Because RSA holds a significant equity position in Reorganized US Airways Group, if RSA disposes of all or a significant amount of this position, it

could cause Reorganized US Airways Group to undergo a new ownership change. This would generally limit (or possibly eliminate) Reorganized US

Airways Group's ability to use post-Effective Date NOLs and other tax attributes.

US Airways utilizes third party service providers to process credit card transactions. If US Airways fails to meet certain conditions, these providers can

(i) require additional cash collateral or additional discretionary amounts upon the occurrence of certain events and (ii) under certain circumstances, terminate

such credit card processing agreements. The termination of credit card processing agreements could have a material adverse effect on the Company's liquidity,

financial condition and results of operations.

The Company's agreement with National Processing Corporation (NPC), a division of National City Bank of Cleveland, for the processing of domestic

Visa and MasterCard transactions expired in May 2003. At that time, US Airways reached an agreement with Bank of America, N.A. to commence the

processing of these transactions. This new agreement expires in December 2008. US Airways was required to deposit $48 million in additional cash collateral

with Bank of America in excess of the amount on deposit with NPC at the commencement of the agreement. The total collateral amount posted with Bank of

America is increased or decreased weekly due to changes in unflown ticket liability, credit ratings, cash balances and other financial and non-financial

measures. The balance at December 31, 2003 was $159 million and was included in noncurrent restricted cash on the Consolidated Balance Sheet.

US Airways Group sold 4,679,000 shares of its Class A Common Stock at a price of $7.34 per share before transaction fees during August 2003 in a

private placement transaction with Aviation Acquisition L.L.C., Goldman, Sachs and Co. and OCM Principal Opportunities Fund II, L.P. These shares relate

to Class A Common Stock retained by US Airways Group from those shares allocated to employees pursuant to the Plan of Reorganization and vested at July

31, 2003. The retained shares represent the employee tax withholding obligation with respect to the vested portion of the restricted stock grants. The amount

of withholding was determined on the basis of a price of $7.34 per Class A common share and applicable federal, state, and local taxes. The net proceeds

received by US Airways Group were $34 million related to this transaction which were advanced to US Airways and offset the Company's remittance to

taxing authorities.

37