US Airways 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

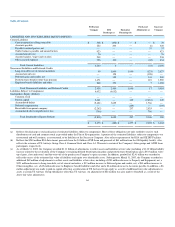

in 2004; $26 million in 2005; $23 million in 2006; $22 million in 2007; and $20 million in 2008 related to these intangible assets.

In connection with fresh-start reporting, the Company recognized route authorities and trademarks on its Consolidated Balance Sheet in the amount of

$36 million and $33 million respectively. Route authorities and trademarks are classified as indefinite lived assets under SFAS 142. Indefinite-lived assets are

not amortized but instead reviewed for impairment annually and more frequently if events or circumstances indicate that the asset may be impaired.

(h) Other assets, net

Other assets, net consist primarily of long-term investments, unamortized debt issuance costs and a long-term note receivable. The balance at December

31, 2002 included unspent bond proceeds to finance various improvements at the Philadelphia International Airport and the unamortized balance of deferred

compensation which were written off upon US Airways' emergence from bankruptcy on March 31, 2003.

(i) Frequent traveler program

US Airways accrues in Traffic balances payable and unused tickets the estimated incremental cost of travel awards earned by participants in its

Dividend Miles frequent traveler program when the requisite mileage award levels are achieved. US Airways also sells mileage credits to certain marketing

partners. US Airways defers the portion of revenue attributable to future transportation and recognizes it as passenger transportation revenue when the service

is provided. The remaining portion of sales proceeds is recognized immediately as a component of Other operating revenues.

(j) Derivative financial instruments

Statement of Financial Accounting Standards No. 133, "Accounting for Derivative Instruments and Hedging Activities" (SFAS 133) was issued in June

1998. This statement established accounting and reporting standards for derivative instruments and hedging activities. SFAS 133 requires the Company to

recognize all derivatives on the balance sheet at fair value. Derivatives that are not hedges must be adjusted to fair value through income. If the derivative is a

hedge, depending on the nature of the hedge, changes in the fair value of derivatives are either offset against the change in fair value of assets, liabilities or

firm commitments through earnings or recognized in other comprehensive income until the hedged item is recognized in earnings. The ineffective portion of a

hedging derivative's change in fair value is immediately recognized in earnings. The Company adopted SFAS 133, as amended, on January 1, 2001. This

resulted in a $7 million credit, net of income taxes, from a cumulative effect of a change in accounting principle, and a $1 million increase, net of income

taxes, in Stockholders' Equity (Deficit).

US Airways' results of operations can be significantly impacted by changes in the price of aircraft fuel. To manage this risk, US Airways periodically

enters into fixed price swap agreements, collar structures and other similar instruments. These agreements substantially fix US Airways' cash flows related to

fuel expense. Because there is not a readily available market for derivatives in aircraft fuel, US Airways primarily uses heating oil and crude oil contracts to

manage its exposure to the movement of aircraft fuel prices. The changes in the market value of the heating oil contracts have a high correlation to changes in

aircraft fuel prices. The agreements generally qualify as cash flow hedges under SFAS 133. US Airways does not purchase or hold any derivative financial

instruments for trading purposes.

Upon adoption of SFAS 133 on January 1, 2001, US Airways recorded the fair market value of its fuel hedge contracts, which was approximately $2

million, on its Consolidated Balance Sheet. On an ongoing basis, US Airways adjusts its balance sheet to reflect the current fair market value of its fuel hedge

contracts. The related gains or losses on these contracts are deferred in accumulated

59