US Airways 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

connection with its reorganization under Chapter 11, the Company reached a settlement with GE that resolved substantially all aircraft, aircraft engine and

loan-related issues. The Company obtained additional financing from GE in the form of a liquidity facility of up to $360 million (GE Liquidity Facility).

Borrowings under the liquidity facility bear interest of LIBOR plus 4.25%. GE received warrants to purchase 3,817,500 shares of Class A Common Stock at

$7.42 per share in Reorganized US Airways Group. GE subsequently agreed to provide committed financing for up to 70 regional jets or $1.4 billion utilizing

lease equity and/or mortgage debt. See "Introduction" above for a discussion of conditions related to the committed financing.

Every obligation of the Company to GE is generally cross-defaulted to all GE obligations including the GE Credit Facility and is cross-collateralized to

the collateral securing the GE Credit Facility.

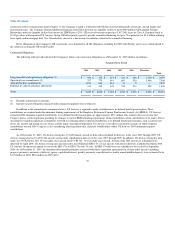

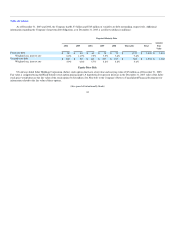

Contractual Obligations

The following table provides detail of the Company's future cash contractual obligations as of December 31, 2003 (dollars in millions).

Payments Due by Period

Total

2004

2005

2006

2007

2008

Thereafter

Long-term debt and capital lease obligations (1) $ 360 $ 142 $ 214 $ 311 $ 308 $ 1,744 $ 3,079

Operating lease commitments (2) 797 779 691 603 530 3,966 7,366

Aircraft purchase commitments 1,934 854 414 31 2 — 3,235

Regional jet capacity purchase agreements 341 245 245 245 233 529 1,838

Total $ 3,432 $ 2,020 $ 1,564 $ 1,190 $ 1,073 $ 6,239 $ 15,518

(1) Excludes related interest amounts.

(2) Includes aircraft obligations financed under enhanced equipment trust certificates.

In addition to the commitments summarized above, US Airways is required to make contributions to its defined benefit pension plans. These

contributions are required under the minimum funding requirements of the Employee Retirement Pension Plan Income Security Act (ERISA). US Airways'

estimated 2004 minimum required contributions to its defined benefit pension plans are approximately $237 million (this estimate does not assume that

Congress passes certain legislation providing for changes to current ERISA funding requirements which would defer certain contributions to be made). Due to

uncertainties regarding significant assumptions involved in estimating future required contributions to its defined benefit pension plans, such as interest rate

levels, the amount and timing of asset returns and the impact of proposed legislation, US Airways is not able to reasonably estimate its future required

contributions beyond 2004. Congress is also considering other legislation that, if passed, would further reduce US Airways' 2004 minimum required

contributions.

As of December 31, 2003, US Airways Group has 19 A320-family aircraft on firm order scheduled for delivery in the years 2007 through 2009. US

Airways Group also has 10 A330-200 aircraft on firm order scheduled for delivery in the years 2007 through 2009. In addition, US Airways Group has firm

orders for 53 CRJ Series 200, 50-seat single-class aircraft and 25 CRJ 701, 70-seat single-class aircraft. All firm-order CRJ aircraft are scheduled to be

delivered by April 2005. US Airways Group also has firm orders for 85 Embraer ERJ-170, 72-seat aircraft, with the first delivery scheduled for March 2004.

US Airways Group has the option to convert the ERJ-170s to ERJ-175s with 76 seats. All ERJ-170 deliveries are scheduled to be received by September

2006. As of December 31, 2003, the minimum determinable payments associated with these acquisition agreements for all firm-order aircraft (including

progress payments, payments at delivery, spares, capitalized interest, penalty payments, cancellation fees and/or nonrefundable deposits) were estimated to be

$1.93 billion in 2004, $854 million in 2005, $414

36