US Airways 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(d) Restricted cash

Restricted cash includes deposits in trust accounts primarily to fund certain taxes and fees and collateralize letters of credit and workers' compensation

claims, credit card processing collateral and fuel hedge collateral. Restricted cash is stated at cost which approximates fair value. See Note 4(b) for further

information.

(e) Materials and supplies, net

Inventories of materials and supplies are valued at the lower of cost or fair value. Costs are determined using average costing methods and are charged

to operations as consumed. An allowance for obsolescence is provided for flight equipment expendable and repairable parts.

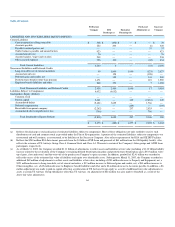

(f) Property and Equipment

Property and equipment is stated at cost or, if acquired under capital lease, at the lower of the present value of minimum lease payments or fair value of

the asset at the inception of the lease. Interest expenses related to the acquisition of certain property and equipment are capitalized as an additional cost of the

asset or as a leasehold improvement if the asset is leased. Costs of major improvements that enhance the usefulness of the asset are capitalized and depreciated

over the estimated useful life of the asset or the modifications, whichever is less.

Depreciation and amortization expense for principal asset classifications is calculated on a straight-line basis to an estimated residual value. Depreciable

lives are 25-30 years for operating flight equipment, 30 years for facilities and 5-10 years for other ground property and equipment. Rotable parts and

assemblies are depreciated over the estimated fleet life of the associated aircraft, on a group basis. The cost of property acquired under capital lease and

improvements to leased assets are depreciated over the term of the lease on a straight-line basis. When property and equipment is sold any gain or loss is

recognized in the Other, net category of Other Income (Expense).

US Airways monitors the recoverability of the carrying value of its long-lived assets. Under the provisions of Statement of Financial Accounting

Standards No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets" (SFAS 144), US Airways recognizes an "impairment charge" when

the expected net undiscounted future cash flows from an asset's use (including any proceeds from disposition) are less than the asset's carrying value and the

asset's carrying value exceeds its fair value.

(g) Goodwill and Other intangibles, net

Goodwill is the cost in excess of fair value of the tangible and identifiable intangible assets of businesses acquired. Excess reorganization value

resulting from the application of SOP 90-7 upon emergence from bankruptcy is also reported and accounted for as goodwill. On January 1, 2002, the

Company adopted Statement of Financial Accounting Standards No. 142, "Goodwill and Other Intangible Assets" (SFAS 142), under which goodwill and

intangible assets acquired in a purchase business combination and determined to have an indefinite useful life are not amortized but instead are assessed for

impairment at least annually and also between annual tests when a significant triggering event occurs. The provisions of SFAS 142 require that a two-step

impairment test be performed on goodwill. In the first step, the Company compares the fair value of the reporting unit to its carrying value. If the fair value of

the reporting unit exceeds the carrying value of the net assets of the reporting unit, goodwill is not impaired and the Company is not required to perform

further testing. If the carrying value of the net assets to the reporting unit exceeds the fair value of the reporting unit, then the Company must perform the

second step in order to determine the implied fair value of the goodwill and compare it to the carrying value of the goodwill. If the carrying value of goodwill

exceeds its implied fair value, then the Company must record an impairment loss equal to the difference. The Company tested its goodwill for impairment

during the fourth quarter of 2003, during the third quarter of 2002 (as a result of its Chapter 11 filing) and during the second quarter of

57