US Airways 2003 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

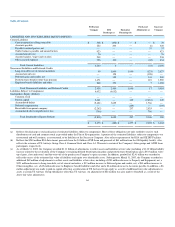

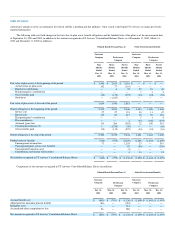

(b) Fair value of financial instruments

In accordance with the provisions of SFAS 115, the fair values for US Airways' short-term investments are determined based upon quoted market

prices. Cash equivalents and restricted cash are carried at cost which approximates fair value. US Airways estimated the fair values of its note receivable and

long-term debt by discounting expected future cash flows using current rates offered to US Airways for notes receivable and debt with similar maturities. The

estimated fair value of the remaining SHC Stock Options (including the clawback provision) was calculated using the Black-Scholes stock option pricing

model. The fair values of the fuel contracts are obtained from dealer quotes. These values represent the estimated amount US Airways would receive or pay to

terminate such agreements as of the valuation date.

US Airways holds warrants in a number of e-commerce companies as a result of entering into service agreements with them. The carrying amount of

the warrants is equal to the estimated fair value, which is calculated using the Black-Scholes stock option pricing model. The carrying amount of these

warrants was not material as of December 31, 2003 and 2002.

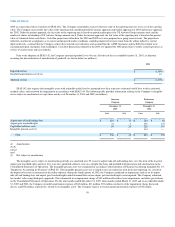

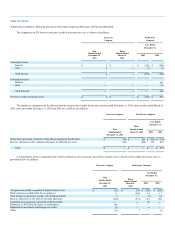

The estimated fair values of US Airways' financial instruments, none of which are held for trading purposes, are summarized as follows (in millions;

brackets denote a liability):

Successor Company

Predecessor Company

December 31, 2003

December 31, 2002

Carrying

Amount

Estimated

Fair

Value

Carrying

Amount

Estimated

Fair

Value

Cash equivalents $ 893 $ 893 $ 554 $ 554

Short-term investments (a) 358 358 49 49

Restricted cash 553 553 514 514

Notes receivable (b) 7 7 17 17

SHC Stock Options (c) 7 7 5 5

Long-term debt (excludes capital lease obligations) (d) (3,029) (2,793) (3,518) (f)

Fuel contracts (e) 38 38 12 12

(a) Classified as available for sale' in accordance with SFAS 115. See also Note 2(c).

(b) Carrying amount included in Receivables, net on the Company's Consolidated Balance Sheets, except for the noncurrent portion ($3 million and $7

million at December 31, 2003 and 2002, respectively) which is included in Other assets, net.

(c) Carrying amount included in Other assets, net on the Company's Consolidated Balance Sheets.

(d) Includes Long-term debt classified as subject to compromise as of December 31, 2002. See also Notes 3(c) and 6.

(e) Carrying amount included in Prepaid expenses and other on the Company's Consolidated Balance Sheets.

(f) As a result of the Company's Chapter 11 filing, the fair value of the debt outstanding could not be reasonably determined as of December 31, 2002.

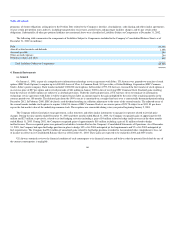

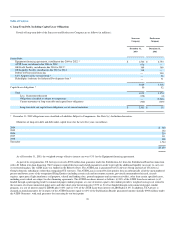

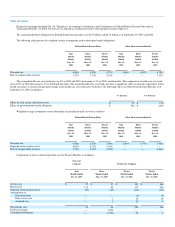

5. Income Taxes

US Airways accounts for income taxes according to the provisions of Statement of Financial Accounting Standards No. 109, "Accounting for Income

Taxes." US Airways files a consolidated federal income tax return with its parent company, US Airways Group. US Airways Group and its wholly owned

subsidiaries allocate tax and tax items, such as net operating losses (NOLs) and tax credits between members of the group based on their proportion of taxable

income and other items. Accordingly, US Airways' tax expense is based on its taxable income, taking into consideration its allocated tax loss carryforwards/

carrybacks and tax credit carryforwards.

During 2001, US Airways recorded a valuation allowance against its net deferred tax asset. In assessing the realizability of the deferred tax assets,

management considers whether it is more likely than not that some portion or all of the deferred tax assets will be realized. The ultimate realization of

deferred tax assets is dependent upon the generation of future taxable income (including reversals

67