US Airways 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

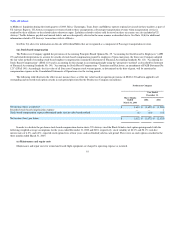

The balance of 40 gates and other facilities currently used by US Airways and US Airways Express carriers at Pittsburgh will be leased on a month-to-month,

non-signatory basis.

Additionally, US Airways has entered into a three-year lease agreement, effective January 5, 2004, for its current on-airport support facilities at

Pittsburgh International Airport, including maintenance hangars, cargo, mail sorting and foodservice facilities. This includes an option for either party to

terminate such agreement with respect to all or part of the facilities after the first year.

US Airways will continue to negotiate with ACAA, Allegheny County and the Commonwealth of Pennsylvania in the hope that a broader agreement

can be reached in order to maintain its hub operations at Pittsburgh. State and local officials are exploring whether new revenue sources can be devoted to

relieve airlines operating at Pittsburgh of some of the cost of servicing the $640 million debt load the airport currently carries. In the meantime, US Airways

has agreed to operate a schedule close to its existing service at Pittsburgh through September 2004 in order to allow negotiations to continue.

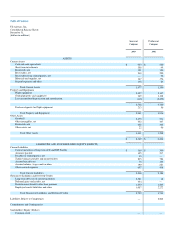

2. Summary of Significant Accounting Policies

(a) Basis of presentation and nature of operations

The accompanying Consolidated Financial Statements include the accounts of US Airways and US Airways Investment Management Company, Inc.

(USIM), a wholly owned subsidiary of US Airways through June 30, 2002. Effective July 1, 2002, USIM and USLM Corporation, a wholly owned subsidiary

of US Airways Group, were merged into US Airways. US Airways is a wholly owned subsidiary of US Airways Group. All significant intercompany

accounts and transactions have been eliminated. However, as discussed further in Note 13, US Airways' financial results are significantly influenced by

related party transactions. Certain prior year amounts have been reclassified to conform with the 2003 presentation. Among these, revenues related to capacity

purchase agreements with US Airways Group's wholly owned subsidiaries and regional jet affiliates were reclassified from the former classification "US

Airways Express transportation revenues" to "Passenger transportation," "Cargo and freight" and "Other," as applicable.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those

estimates. The principal areas of judgment relate to impairment of goodwill, passenger revenue recognition, fresh-start reporting, impairment of long-lived

assets and intangible assets subject to amortization, and pensions and other postretirement benefits.

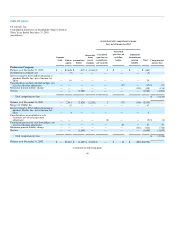

In accordance with SOP 90-7, the Company adopted fresh-start reporting on the Effective Date. References in the Consolidated Financial Statements

and the Notes to the Consolidated Financial Statements to "Predecessor Company" refer to the Company prior to March 31, 2003. References to "Successor

Company" refer to the Company on and after March 31, 2003, after giving effect to the application of fresh-start reporting. Fresh-start reporting requires

assets and liabilities be adjusted to fair value on the emergence date. The term "cost" as is used in the Successor Company's Notes to the Consolidated

Financial Statements is after giving effect to such adjustments. See Note 3(a) for information related to fresh-start reporting.

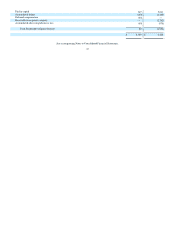

SOP 90-7 requires that the financial statements for periods following the Chapter 11 filing through the Effective Date distinguish transactions and

events that are directly associated with the reorganization from the ongoing operations of the business. Accordingly, revenues, expenses, realized gains and

losses and provisions for losses directly associated with the reorganization and

53