US Airways 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

airline threat will significantly intensify over the next few years. The growing presence of competitors' regional jets also poses a threat to the Company.

Regional jets are faster, quieter and more comfortable than turboprops and generally preferred by customers over turboprops. In recent years, the Company

has lost significant market share in markets where it operates with turboprop aircraft and competitors have introduced regional jet service. As discussed

below, the Company is implementing a plan to deploy additional regional jets and introduced 43 regional jets into its network during 2003, a 61% increase.

Aviation fuel is typically the Company's second largest expense. Prices and availability of all petroleum products are subject to political, economic and

market factors that are generally outside of its control. Accordingly, the price and availability of aviation fuel, as well as other petroleum products, can be

unpredictable. Prices may be affected by many factors, including the impact of political instability on crude production, especially in Russia and OPEC

countries; unexpected changes to the availability of petroleum products due to disruptions in distribution systems or refineries; unpredicted increases to oil

demand due to weather or the pace of economic growth; inventory levels of crude, refined products and natural gas; and other factors, such as the relative

fluctuation between the U.S. dollar and other major currencies and influence of speculative positions on the futures exchanges. Because the operations of the

Company are dependent upon aviation fuel, significant increases in aviation fuel costs could materially and adversely affect liquidity, results of operations and

financial condition. Furthermore, the implications of a sharp increase in the price of aviation fuel for a prolonged period of time would be significant. Recent

increases in fuel prices coincided with the decline in the value of the U.S. dollar which negatively impacted fuel prices in 2003. If this trend persists, the

Company faces the risk of sustained high fuel prices. The Company utilizes financial instruments designed to reduce its exposure related to fuel price

increases (see Note 4 for more information on the Company's derivative instruments.)

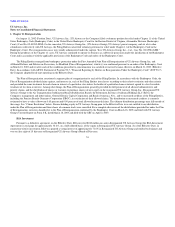

As discussed in more detail above, the Company emerged from bankruptcy on March 31, 2003. In connection with this, US Airways received a $900

million loan guarantee under the Stabilization Act from the Stabilization Board in connection with a $1 billion term loan financing. The definitive

documentation relating to the ATSB Loan contains covenants that require the Company to satisfy ongoing financial requirements, including debt ratio, fixed

charge coverage ratio and minimum liquidity. The ATSB Loan contains covenants that also limit, among other things, the Company's ability to pay dividends

on its common stock, make additional corporate investments and acquisitions, enter into mergers and consolidations and modify certain concessions obtained

as part of the Chapter 11 reorganization. Effective March 12, 2004, US Airways obtained covenant relief for the measurement periods beginning June 30,

2004 through December 31, 2005. If the Company is unable to meet these financial covenants, as amended, the Company would be in default under the ATSB

Loan and the Stabilization Board would have the right to accelerate the ATSB Loan and exercise other remedies against the Company. Such acceleration

would have a material adverse effect on the Company's future liquidity, results of operations and financial condition.

A key component to the Company's overall restructuring plan is the increased usage of regional jets. The Company uses regional jets to fly into low-

density markets where large-jet flying is not economical as well as replace turbo props with regional jets to better meet customer preferences. US Airways'

agreement with its pilots provides that it may operate up to 465 regional jets, subject to certain restrictions. In May 2003, US Airways Group entered into

agreements to purchase a total of 170 regional jets from Bombardier, Inc. (Bombardier) and Empresa Brasileira de Aeronautica S.A. Through December 31,

2003, the Company had taken delivery of seven aircraft under the Bombardier purchase contract. The order equally splits between the two regional jet

manufacturers a combination of 170 firm orders and 380 options to purchase regional jets. The Company has secured approximately 85% to 90% of the

necessary financing for its firm-order regional jet aircraft. These financings include commitments from General Electric (GE) and from the respective

airframe manufacturers and are subject to certain credit standards or financial tests. Among the applicable credit standards under the aircraft financing

commitments is the requirement that US Airways Group or US Airways maintains a minimum corporate credit rating of "B-" by Standard & Poor's (S&P) or

55