US Airways 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

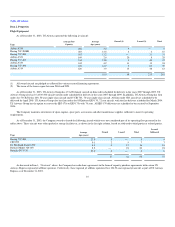

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

General Information

Certain of the statements contained herein should be considered "forward-looking statements" within the meaning of the Private Securities Litigation

Reform Act of 1995, which reflect the current views of US Airways, Inc. (US Airways or the Company) with respect to current events and financial

performance. You can identify these statements by forward-looking words such as "may," "will," "expect," "intend," "anticipate," "believe," "estimate,"

"plan," "could," "should," and "continue" or similar words. These forward-looking statements may also use different phrases. Such forward-looking

statements are and will be, as the case may be, subject to many risks, uncertainties and factors relating to the Company's operations and business environment

which may cause the actual results of the Company to be materially different from any future results, express or implied, by such forward-looking statements.

Factors that could cause actual results to differ materially from these forward-looking statements include, but are not limited to, the following: the ability of

the Company to operate pursuant to the terms of its financing facilities (particularly the financial covenants); the ability of the Company to obtain and

maintain normal terms with vendors and service providers; the Company's ability to maintain contracts that are critical to its operations; the ability of the

Company to fund and execute its business plan; the ability of the Company to attract, motivate and/or retain key executives and associates; the ability of the

Company to attract and retain customers; the ability of the Company to maintain satisfactory labor relations; demand for transportation in the markets in

which the Company operates; economic conditions; labor costs; financing availability and costs; aviation fuel costs; security-related and insurance costs;

competitive pressures on pricing (particularly from lower-cost competitors) and on demand (particularly from low-cost carriers and multi-carrier alliances);

weather conditions; government legislation and regulation; impact of the Iraqi war and the Iraqi occupation; other acts of war or terrorism; and other risks and

uncertainties listed from time to time in the Company's reports to the SEC. There may be other factors not identified above of which the Company is not

currently aware that may affect matters discussed in the forward-looking statements, and may also cause actual results to differ materially from those

discussed. The Company assumes no obligation to update such estimates to reflect actual results, changes in assumptions or changes in other factors affecting

such estimates other than as required by law.

Introduction

While the Company emerged from bankruptcy in March 2003, it still incurred a significant loss from operations for the year. Some of the key factors

causing these results were the impact of the hostilities in Iraq on passenger demand, rapid growth of low cost competition, the continued pressure on industry

pricing and significant increases in fuel prices. Many of these factors are expected to continue into 2004 and beyond and are discussed below. In addition, also

discussed below are key issues regarding financing arrangements which are critical to the ongoing operation of the Company.

Although the U.S. economy improved in 2003 resulting in modestly favorable travel trends, the Company faced weak passenger demand during the first

half of the year due to the war and subsequent continued hostilities in Iraq and the Company continues to face intense competition from the growing presence

of low-fare low-cost airlines and competitors' regional jets in its markets. The rapid growth of low-fare low-cost airlines has had a profound impact on

industry revenues that poses a threat to traditional network carriers. Using the advantage of low unit costs, these carriers offer lower passenger fares,

particularly those targeted at business passengers, in order to shift demand from traditional network carriers. As a result of growth, these low-fare low-cost

carriers now transport approximately 25% of all domestic U.S. passengers compared to less

19