US Airways 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

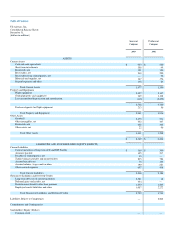

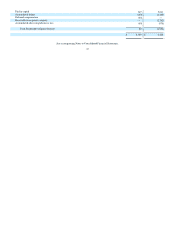

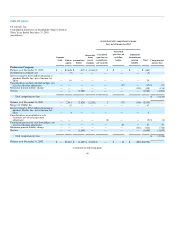

restructuring of the business are reported separately as Reorganization items, net in the Consolidated Statements of Operations. The Consolidated Balance

Sheet as of December 31, 2002 distinguishes pre-petition liabilities subject to compromise from both those pre-petition liabilities that are not subject to

compromise and from post-petition liabilities. Liabilities subject to compromise are reported at the amounts expected to be allowed, even if they may be

settled for lesser amounts. In addition, cash used for reorganization items is disclosed separately in the Consolidated Statements of Cash Flows.

US Airways is a major U.S. air carrier engaged primarily in the business of transporting passengers, property and mail. US Airways enplaned

approximately 41 million passengers during 2003 and was the seventh largest U.S. air carrier, as ranked by revenue passenger miles (RPMs). US Airways

operates predominantly in the eastern U.S. with major connecting hubs at airports in Charlotte, Philadelphia and Pittsburgh. US Airways also has substantial

operations at Boston's Logan International Airport (Logan), New York's LaGuardia Airport and Washington's Ronald Reagan Washington National Airport

(Reagan National).

(b) Operating environment

Most of the operations of the Company are in competitive markets. Competitors include other air carriers along with other modes of transportation.

Although a competitive strength in some regards, the concentration of significant operations in the eastern U.S. results in US Airways being susceptible to

changes in certain regional conditions that may have an adverse effect on the Company's financial condition and results of operations.

Personnel costs represent the Company's largest expense category. As of December 31, 2003, the Company employed approximately 26,700 active full-

time equivalent employees. Approximately 88% of the Company's active employees are covered by collective bargaining agreements with various labor

unions.

While the Company emerged from bankruptcy in March 2003, it still incurred a significant loss from operations for the year. Some of the key factors

causing these results were the impact of the hostilities in Iraq on passenger demand, rapid growth of low cost competition, the continued pressure on industry

pricing and significant increases in fuel prices. Many of these factors are expected to continue into 2004 and beyond and are discussed below. In addition, also

discussed below are key issues regarding financing arrangements which are critical to the ongoing operation of the Company.

Although the U.S. economy improved in 2003 resulting in modestly favorable travel trends, the Company faced weak passenger demand during the first

half of the year due to the war and subsequent continued hostilities in Iraq and the Company continues to face intense competition from the growing presence

of low-fare low-cost airlines and competitors' regional jets in its markets. The rapid growth of low-fare low-cost airlines has had a profound impact on

industry revenues that poses a threat to traditional network carriers. Using the advantage of low unit costs, these carriers offer lower passenger fares,

particularly those targeted at business passengers, in order to shift demand from traditional network carriers. As a result of growth, these low-fare low-cost

carriers now transport approximately 25% of all domestic U.S. passengers compared to less than 10% a decade ago. They now compete for, and thus

influence industry pricing on, approximately 75% of all U.S. domestic passenger ticket sales compared to less than 20% a decade ago. Low-fare low-cost

airlines are increasingly offering passenger amenities, such as in-flight entertainment and leather seating, which were once traditionally offered by only

network carriers. In addition, low-fare low-cost airlines are receiving an increasing number of operating rights in slot-restricted airports. The threat from low-

fare low-cost airlines accelerated noticeably in 2003 as the capital markets opened up to them resulting in their ordering hundreds of aircraft. Several low-fare

low-cost airlines, including Southwest Airlines and Frontier Airlines, have launched service or announced plans to launch service at Philadelphia, a hub

airport for US Airways. The surge in aircraft orders and better recent financial performance relative to traditional network carriers suggest that the low-fare

low-cost

54