UPS 2015 Annual Report Download - page 98

Download and view the complete annual report

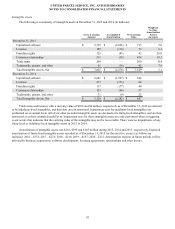

Please find page 98 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

86

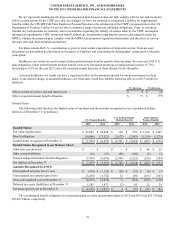

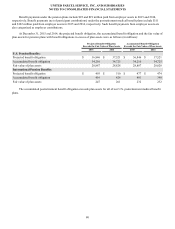

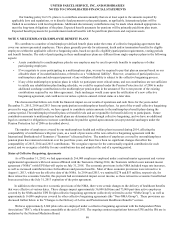

Our funding policy for U.S. plans is to contribute amounts annually that are at least equal to the amounts required by

applicable laws and regulations, or to directly fund payments to plan participants, as applicable. International plans will be

funded in accordance with local regulations. Additional discretionary contributions may be made when deemed appropriate to

meet the long-term obligations of the plans. Expected benefit payments for pensions will be primarily paid from plan trusts.

Expected benefit payments for postretirement medical benefits will be paid from plan trusts and corporate assets.

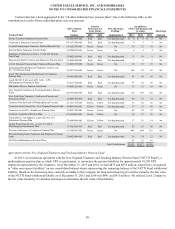

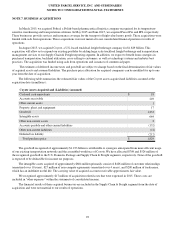

NOTE 5. MULTIEMPLOYER EMPLOYEE BENEFIT PLANS

We contribute to a number of multiemployer defined benefit plans under the terms of collective bargaining agreements that

cover our union-represented employees. These plans generally provide for retirement, death and/or termination benefits for eligible

employees within the applicable collective bargaining units, based on specific eligibility/participation requirements, vesting periods

and benefit formulas. The risks of participating in these multiemployer plans are different from single-employer plans in the following

aspects:

• Assets contributed to a multiemployer plan by one employer may be used to provide benefits to employees of other

participating employers.

• If we negotiate to cease participating in a multiemployer plan, we may be required to pay that plan an amount based on our

allocable share of its underfunded status, referred to as a "withdrawal liability". However, cessation of participation in a

multiemployer plan and subsequent payment of any withdrawal liability is subject to the collective bargaining process.

• If any of the multiemployer pension plans in which we participate enter critical status, and our contributions are not sufficient

to satisfy any rehabilitation plan funding schedule, we could be required under the Pension Protection Act of 2006 to make

additional surcharge contributions to the multiemployer pension plan in the amount of five to ten percent of the existing

contributions required by our labor agreement. Such surcharges would cease upon the ratification of a new collective

bargaining agreement, and could not recur unless a plan re-entered critical status at a later date.

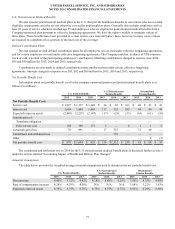

The discussion that follows sets forth the financial impact on our results of operations and cash flows for the years ended

December 31, 2015, 2014 and 2013 from our participation in multiemployer benefit plans. As part of the overall collective bargaining

process for wage and benefit levels, we have agreed to contribute certain amounts to the multiemployer benefit plans during the

contract period. The multiemployer benefit plans set benefit levels and are responsible for benefit delivery to participants. Future

contribution amounts to multiemployer benefit plans are determined only through collective bargaining, and we have no additional

legal or constructive obligation to increase contributions beyond the agreed-upon amounts (except potential surcharges under the

Pension Protection Act of 2006 as described above).

The number of employees covered by our multiemployer health and welfare plans increased during 2014, affecting the

comparability of contributions with prior years, as a result of provisions of the new collective bargaining agreement with the

International Brotherhood of Teamsters (“Teamsters”) discussed below. The number of employees covered by our multiemployer

pension plans has remained consistent over the past three years, and there have been no significant changes that affect the

comparability of 2015, 2014 and 2013 contributions. We recognize expense for the contractually-required contribution for each

period, and we recognize a liability for any contributions due and unpaid at the end of a reporting period.

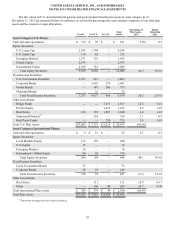

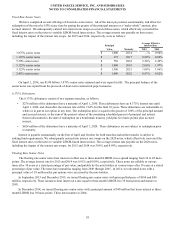

Status of Collective Bargaining Agreements

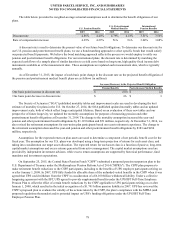

As of December 31, 2015, we had approximately 266,000 employees employed under a national master agreement and various

supplemental agreements with local unions affiliated with the Teamsters. During 2014, the Teamsters ratified a new national master

agreement (“NMA”) with UPS that will expire on July 31, 2018. The economic provisions in the NMA included wage rate increases,

as well as increased contribution rates for healthcare and pension benefits. Most of these economic provisions were retroactive to

August 1, 2013, which was the effective date of the NMA. In 2014 and 2015, we remitted $278 and $53 million, respectively, for

these retroactive economic benefits; this payment had an immaterial impact on net income, as these retroactive economic benefits had

been accrued since the July 31, 2013 expiration of the prior agreement.

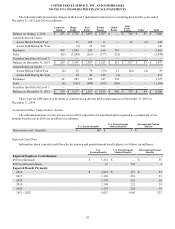

In addition to the retroactive economic provisions of the NMA, there were certain changes to the delivery of healthcare benefits

that were effective at various dates. These changes impact approximately 36,000 full-time and 73,000 part-time active employees

covered by the NMA and the UPS Freight collective bargaining agreement (collectively referred to as the “NMA Group”), as well as

approximately 16,000 employees covered by other collective bargaining agreements (the “Non-NMA Group”). These provisions are

discussed further below in the "Changes to the Delivery of Active and Postretirement Healthcare Benefits" section.

We have approximately 2,600 pilots who are employed under a collective bargaining agreement with the Independent Pilots

Association ("IPA"), which became amendable at the end of 2011. The ongoing contract negotiations between UPS and the IPA are in

mediation by the National Mediation Board.