UPS 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

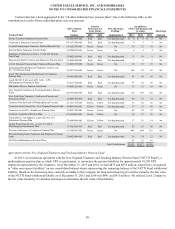

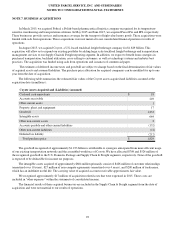

NOTE 7. BUSINESS ACQUISITIONS

In March 2015, we acquired Poltraf, a Polish-based pharmaceutical logistics company recognized for its temperature-

sensitive warehousing and transportation solutions. In May 2015 and June 2015, we acquired Parcel Pro and IPS, respectively.

These businesses provide services and insurance coverage for the transport of high value luxury goods. These acquisitions were

funded with cash from operations. These acquisitions were not material to our consolidated financial position or results of

operations.

In August 2015, we acquired Coyote, a U.S.-based truckload freight brokerage company for $1.829 billion. This

acquisition will allow us to expand our existing portfolio by adding large scale truckload freight brokerage and transportation

management services to our Supply Chain & Freight reporting segment. In addition, we expect to benefit from synergies in

purchased transportation, backhaul utilization, cross-selling to customers, as well as technology systems and industry best

practices. The acquisition was funded using cash from operations and issuances of commercial paper.

The estimates of deferred income taxes and goodwill are subject to change based on the final determination of fair values

of acquired assets and assumed liabilities. The purchase price allocation for acquired companies can be modified for up to one

year from the date of acquisition.

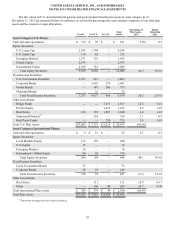

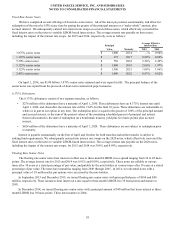

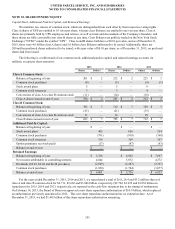

The following table summarizes the estimated fair values of the Coyote assets acquired and liabilities assumed at the

acquisition date (in millions):

Coyote Assets Acquired and (Liabilities) Assumed:

Cash and cash equivalents

$

18

Accounts receivable

249

Other current assets

1

Property, plant, and equipment

17

Goodwill

1,233

Intangible assets

664

Other non-current assets

2

Accounts payable and other current liabilities

(132)

Other non-current liabilities

(11)

Deferred tax liability

(212)

Total purchase price

$

1,829

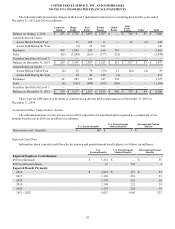

The goodwill recognized of approximately $1.233 billion is attributable to synergies anticipated from more efficient usage

of our existing transportation networks and the assembled workforce of Coyote. We have allocated $709 and $524 million of

the recognized goodwill to the U.S. Domestic Package and Supply Chain & Freight segments, respectively. None of the goodwill

is expected to be deductible for income tax purposes.

The intangible assets acquired of approximately $664 million primarily consist of $426 million of customer relationships

(amortized over 10 years), $27 million of non-compete agreements (amortized over 4 years), and $200 million of trade name,

which has an indefinite useful life. The carrying value of acquired accounts receivable approximates fair value.

We recognized approximately $17 million of acquisition related costs that were expensed in 2015. These costs are

included in "other expenses" within the statements of consolidated income.

The financial results of these acquired businesses are included in the Supply Chain & Freight segment from the date of

acquisition and were not material to our results of operations.

93