UPS 2015 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

111

NOTE 13. INCOME TAXES

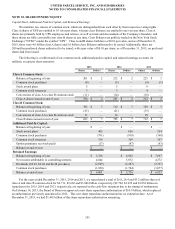

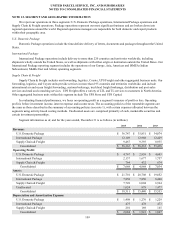

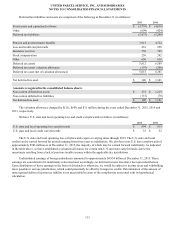

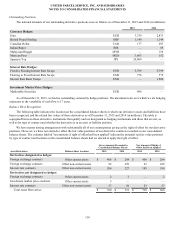

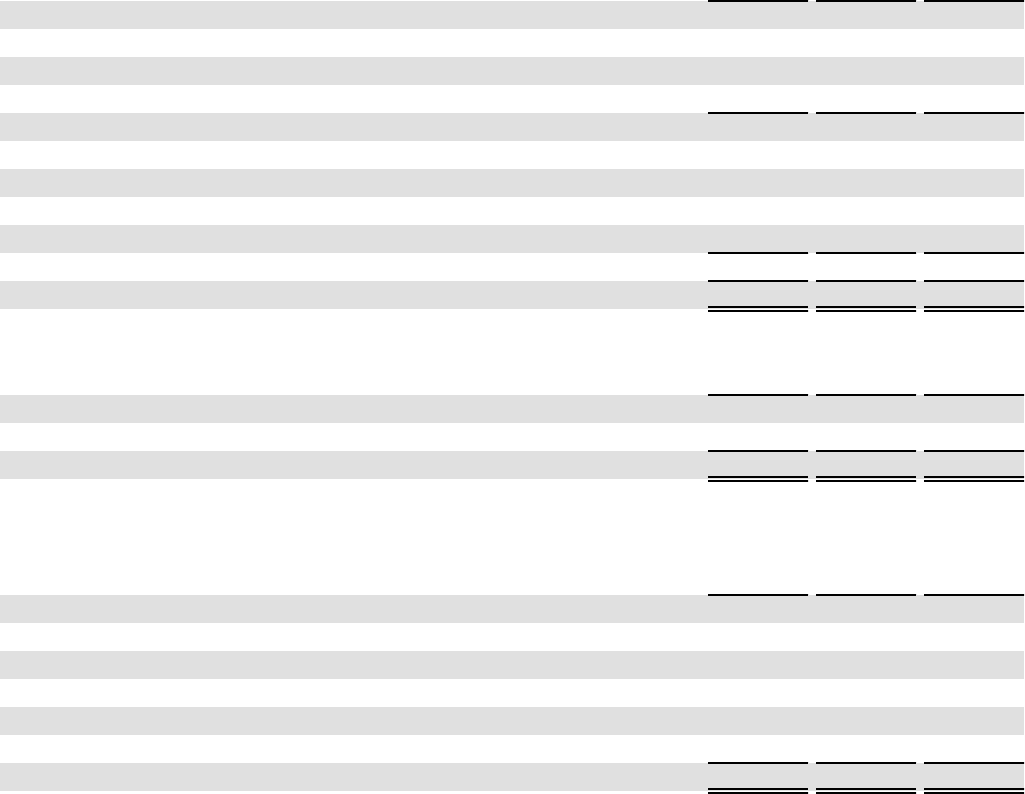

The income tax expense (benefit) for the years ended December 31 consists of the following (in millions):

2015 2014 2013

Current:

U.S. Federal $ 1,634 $ 932 $ 2,181

U.S. State and Local 88 103 205

Non-U.S. 236 185 162

Total Current 1,958 1,220 2,548

Deferred:

U.S. Federal 469 427 (242)

U.S. State and Local 65 (11)(22)

Non-U.S. 6 (31)18

Total Deferred 540 385 (246)

Total Income Tax Expense $ 2,498 $ 1,605 $ 2,302

Income before income taxes includes the following components (in millions):

2015 2014 2013

United States $ 6,348 $ 3,819 $ 6,040

Non-U.S. 994 818 634

Total Income Before Income Taxes: $ 7,342 $ 4,637 $ 6,674

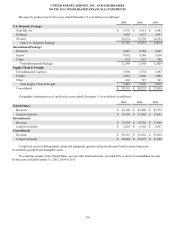

A reconciliation of the statutory federal income tax rate to the effective income tax rate for the years ended December 31

consists of the following:

2015 2014 2013

Statutory U.S. federal income tax rate 35.0% 35.0% 35.0%

U.S. state and local income taxes (net of federal benefit) 1.7 1.2 2.1

Non-U.S. tax rate differential (1.2)(2.4)(1.3)

Nondeductible/nontaxable items 0.2 1.3 (0.2)

U.S. federal tax credits (1.3)(1.5)(1.2)

Other (0.4) 1.0 0.1

Effective income tax rate 34.0% 34.6% 34.5%

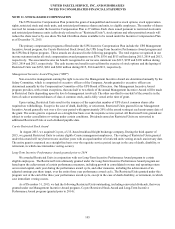

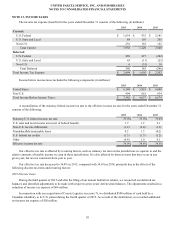

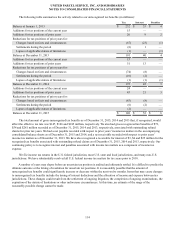

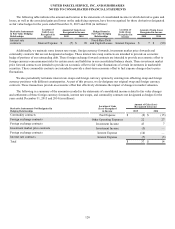

Our effective tax rate is affected by recurring factors, such as statutory tax rates in the jurisdictions we operate in and the

relative amounts of taxable income we earn in those jurisdictions. It is also affected by discrete items that may occur in any

given year, but are not consistent from year to year.

Our effective tax rate decreased to 34.0% in 2015, compared with 34.6% in 2014, primarily due to the effects of the

following discrete tax items and recurring factors:

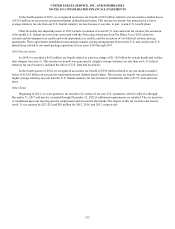

2015 Discrete Items

During the third quarter of 2015 and after the filing of our annual federal tax returns, we reconciled our deferred tax

balances and identified adjustments to be made with respect to prior years’ deferred tax balances. The adjustments resulted in a

reduction of income tax expense of $66 million.

In connection with our acquisition of Coyote Logistics (see note 7), we distributed $500 million of cash held by a

Canadian subsidiary to its U.S. parent during the fourth quarter of 2015. As a result of the distribution, we recorded additional

net income tax expense of $28 million.