UPS 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

78

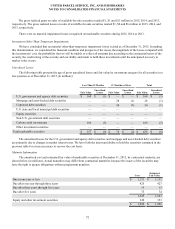

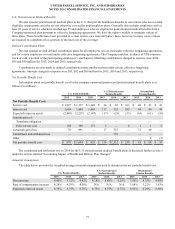

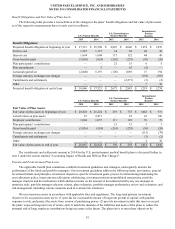

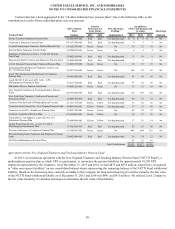

The table below provides the weighted-average actuarial assumptions used to determine the benefit obligations of our

plans.

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International

Pension Benefits

2015 2014 2015 2014 2015 2014

Discount rate 4.86% 4.40% 4.79% 4.18% 3.51% 3.56%

Rate of compensation increase 4.29% 4.29% N/A N/A 3.04% 3.08%

A discount rate is used to determine the present value of our future benefit obligations. To determine our discount rate for

our U.S. pension and postretirement benefit plans, we use a bond matching approach to select specific bonds that would satisfy

our projected benefit payments. We believe the bond matching approach reflects the process we would employ to settle our

pension and postretirement benefit obligations. For our international plans, the discount rate is determined by matching the

expected cash flows of a sample plan of similar duration to a yield curve based on long-term, high quality fixed income debt

instruments available as of the measurement date. These assumptions are updated each measurement date, which is typically

annually.

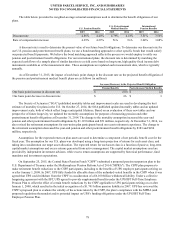

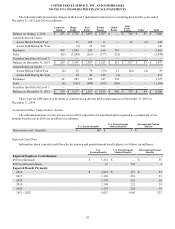

As of December 31, 2015, the impact of each basis point change in the discount rate on the projected benefit obligation of

the pension and postretirement medical benefit plans are as follows (in millions):

Increase (Decrease) in the Projected Benefit Obligation

Pension Benefits Postretirement Medical Benefits

One basis point increase in discount rate $ (60)$ (2)

One basis point decrease in discount rate $ 66 $ 3

The Society of Actuaries ("SOA") published mortality tables and improvement scales are used in developing the best

estimate of mortality for plans in the U.S. On October 27, 2014, the SOA published updated mortality tables and an updated

improvement scale, both of which reflect longer anticipated lifetimes. Based on an evaluation of these new tables and our

perspective of future longevity, we updated the mortality assumptions for purposes of measuring pension and other

postretirement benefit obligations at December 31, 2014. The change to the mortality assumption increased the year-end

pension and other postretirement benefit obligations by $1.119 billion and $51 million, respectively. At December 31, 2014, we

also revised the retirement assumptions for non-union plan participants based on recent retirement experience. The change to

the retirement assumption decreased the year-end pension and other postretirement benefit obligations by $383 and $234

million, respectively.

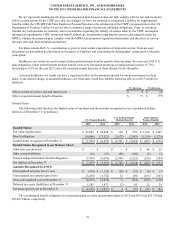

Assumptions for the expected return on plan assets are used to determine a component of net periodic benefit cost for the

fiscal year. The assumption for our U.S. plans was developed using a long-term projection of returns for each asset class, and

taking into consideration our target asset allocation. The expected return for each asset class is a function of passive, long-term

capital market assumptions and excess returns generated from active management. The capital market assumptions used are

provided by independent investment advisors, while excess return assumptions are supported by historical performance, fund

mandates and investment expectations.

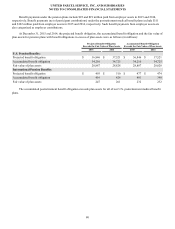

On September 25, 2015, the Central States Pension Fund ("CSPF") submitted a proposed pension suspension plan to the

U.S. Department of Treasury under the Multiemployer Pension Reform Act of 2014 ("MPRA"). The CSPF plan proposes to

make retirement benefit reductions to the CSPF participants, including to the benefits of UPS employee participants retiring on

or after January 1, 2008. In 2007, UPS fully funded its allocable share of the unfunded vested benefits in the CSPF when it was

agreed that UPS could withdraw from the CSPF in consideration of a $6.100 billion withdrawal liability. Under a collective

bargaining agreement with the IBT, UPS agreed to provide supplemental benefits under the UPS/IBT Full-Time Employee

Pension Plan to offset the effect of certain benefit reductions by the CSPF applicable to UPS participants retiring on or after

January 1, 2008, which resulted in the initial recognition of a $1.701 billion pension liability in 2007. UPS has reviewed the

CSPF’s proposed plan to evaluate the validity of the actions taken by the CSPF, the plan’s compliance with the MPRA (and

proposed regulations thereunder) and its potential impact on UPS’s funding obligations under the UPS/IBT Full-Time

Employee Pension Plan.