UPS 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

48

Apart from the transactions described above, operating cash flow was impacted by changes in our working capital

position, payments for income taxes, and changes in hedge margin payables and receivables. Cash payments for income taxes

were $1.913, $1.524 and $2.712 billion for 2015, 2014 and 2013, respectively, and were primarily impacted by the timing of

current tax deductions. The net hedge margin collateral received from derivative counterparties was $170, $421and $67 million

during 2015, 2014 and 2013, respectively, due to the increased net fair value asset position of the derivative contracts used in

our currency and interest rate hedging programs.

As of December 31, 2015, the total of our worldwide holdings of cash, cash equivalents and marketable securities were

$4.726 billion, of which $2.516 billion was held by foreign subsidiaries. The amount of cash, cash equivalents and marketable

securities held by our U.S. and foreign subsidiaries fluctuates throughout the year due to a variety of factors, including the

timing of cash receipts and disbursements in the normal course of business. Cash provided by operating activities in the United

States continues to be our primary source of funds to finance domestic operating needs, capital expenditures, share repurchases

and dividend payments to shareowners. To the extent that such amounts represent previously untaxed earnings, the cash, cash

equivalents and marketable securities held by foreign subsidiaries would be subject to tax if such amounts were repatriated in

the form of dividends; however, not all international balances would have to be repatriated in the form of a dividend if returned

to the U.S. When amounts earned by foreign subsidiaries are expected to be indefinitely reinvested, no accrual for taxes is

provided.

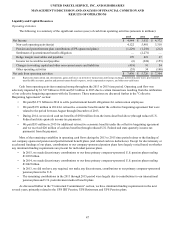

Investing Activities

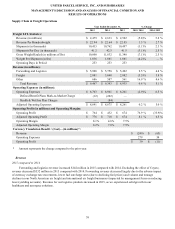

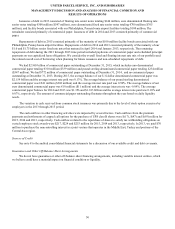

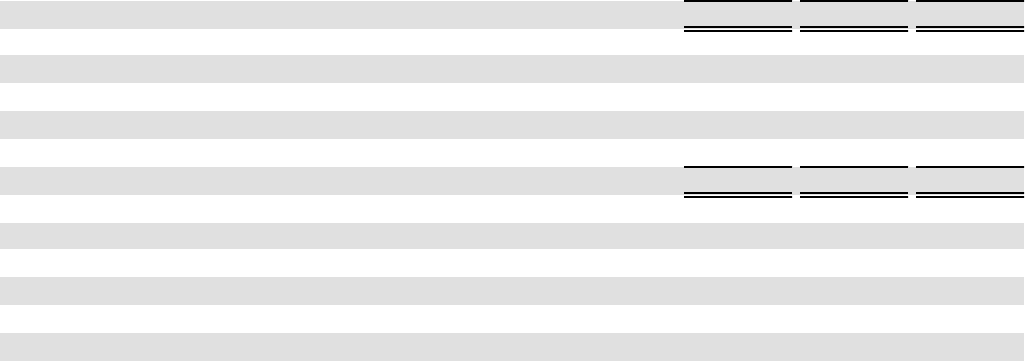

Our primary sources (uses) of cash for investing activities were as follows (amounts in millions):

2015 2014 2013

Net cash used in investing activities $ (5,309)$(2,801)$(2,114)

Capital Expenditures:

Buildings and facilities $ (996)$ (808)$ (483)

Aircraft and parts (27)(44)(478)

Vehicles (936)(1,061)(662)

Information technology (420)(415)(442)

$(2,379)$(2,328)$(2,065)

Capital Expenditures as a % of Revenue 4.1% 4.0% 3.7%

Other Investing Activities:

Proceeds from disposals of property, plant and equipment $ 26 $ 53 $ 104

Net decrease in finance receivables $ 5 $ 44 $ 39

Net (purchases) sales of marketable securities $ (1,027)$ (419)$ 9

Cash received (paid) for business acquisitions and dispositions $ (1,904)$ (88)$ (22)

Other investing activities $ (30)$ (63)$ (179)

We have commitments for the purchase of vehicles, equipment and real estate to provide for the replacement of existing

capacity and anticipated future growth. We generally fund our capital expenditures with our cash from operations. Future

capital spending for anticipated growth and replacement assets will depend on a variety of factors, including economic and

industry conditions. We anticipate that our capital expenditures for 2016 will be approximately $2.8 billion.

Capital spending on aircraft declined over the 2013 to 2015 period, as we completed the scheduled deliveries of a

previous order for the Boeing 767-300ERF aircraft in 2013. Capital spending on vehicles increased during the 2013 to 2015

period in our U.S. and international package businesses and our freight unit, due to vehicle replacements, technology

enhancements and new vehicle orders to support volume growth. Capital expenditures on buildings and facilities also increased

in the 2013 to 2015 period, and included hub automation and capacity expansion projects in the U.S. during 2015, as well as

expansion and new construction projects at facilities in Europe and Asia (including a $200 million expansion at our European

air hub in Cologne, Germany that was completed in 2014).