UPS 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

114

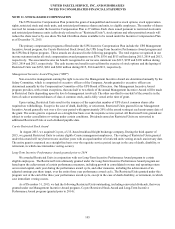

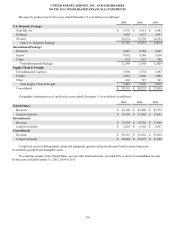

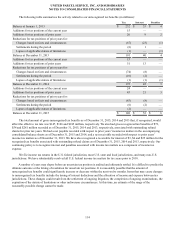

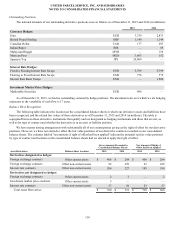

The following table summarizes the activity related to our unrecognized tax benefits (in millions):

Tax Interest Penalties

Balance at January 1, 2013 $ 232 $ 53 $ 4

Additions for tax positions of the current year 15 — —

Additions for tax positions of prior years 20 9 2

Reductions for tax positions of prior years for:

Changes based on facts and circumstances (67)(23)(1)

Settlements during the period (8)1—

Lapses of applicable statute of limitations (1)— (1)

Balance at December 31, 2013 191 40 4

Additions for tax positions of the current year 15 — —

Additions for tax positions of prior years 51 13 —

Reductions for tax positions of prior years for:

Changes based on facts and circumstances (74)(8)—

Settlements during the period (10)(2)—

Lapses of applicable statute of limitations (1)(1)(1)

Balance at December 31, 2014 172 42 3

Additions for tax positions of the current year 24 — —

Additions for tax positions of prior years 45 21 3

Reductions for tax positions of prior years for:

Changes based on facts and circumstances (85)(8)—

Settlements during the period (6)(2)—

Lapses of applicable statute of limitations (2)— —

Balance at December 31, 2015 $ 148 $ 53 $ 6

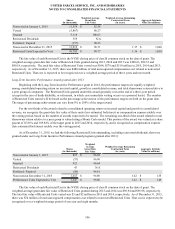

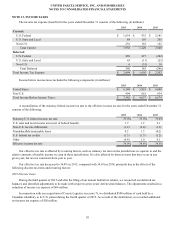

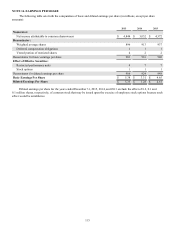

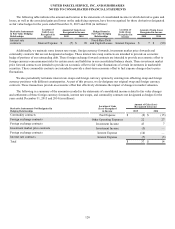

The total amount of gross unrecognized tax benefits as of December 31, 2015, 2014 and 2013 that, if recognized, would

affect the effective tax rate was $147, $166 and $185 million, respectively. We also had gross recognized tax benefits of $73,

$54 and $281 million recorded as of December 31, 2015, 2014 and 2013, respectively, associated with outstanding refund

claims for prior tax years. We had a net payable recorded with respect to prior years’ income tax matters in the accompanying

consolidated balance sheets as of December 31, 2015 and 2014, and a net receivable recorded with respect to prior years’

income tax matters as of December 31, 2013. We have also recognized a receivable for interest of $3, $4 and $25 million for the

recognized tax benefits associated with outstanding refund claims as of December 31, 2015, 2014 and 2013, respectively. Our

continuing policy is to recognize interest and penalties associated with income tax matters as a component of income tax

expense.

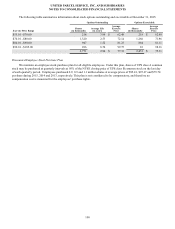

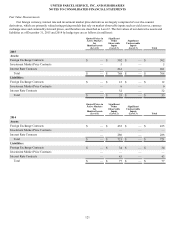

We file income tax returns in the U.S. federal jurisdiction, most U.S. state and local jurisdictions, and many non-U.S.

jurisdictions. We have substantially resolved all U.S. federal income tax matters for tax years prior to 2010.

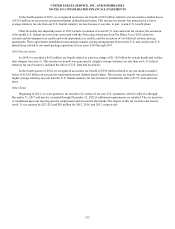

A number of years may elapse before an uncertain tax position is audited and ultimately settled. It is difficult to predict the

ultimate outcome or the timing of resolution for uncertain tax positions. It is reasonably possible that the amount of

unrecognized tax benefits could significantly increase or decrease within the next twelve months. Items that may cause changes

to unrecognized tax benefits include the timing of interest deductions and the allocation of income and expense between tax

jurisdictions. These changes could result from the settlement of ongoing litigation, the completion of ongoing examinations, the

expiration of the statute of limitations or other unforeseen circumstances. At this time, an estimate of the range of the

reasonably possible change cannot be made.