UPS 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

26

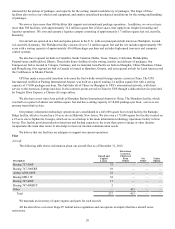

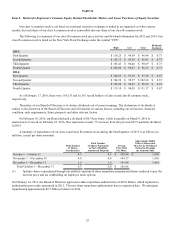

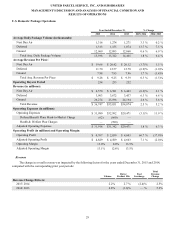

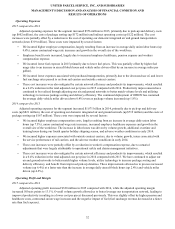

Items Affecting Comparability

The year-over-year comparisons of our financial results are affected by the following items (in millions):

Year Ended December 31,

2015 2014 2013

Operating Expenses:

Defined Benefit Plans Mark-to-Market Charge $ 118 $ 1,062 $ —

Health & Welfare Plan Charges — 1,102 —

TNT Termination Fee and Related Expenses — — 284

Gain Upon Liquidation of Foreign Subsidiary — — (245)

Total Adjustments to Operating Expenses 118 2,164 39

Income Tax Expense (Benefit) from the Items Above (39)(807)(75)

Total Adjustments to Net Income $ 79 $ 1,357 $ (36)

These items have been excluded from comparisons of "adjusted" operating expenses, operating profit, operating margin

and income taxes in the discussion that follows.

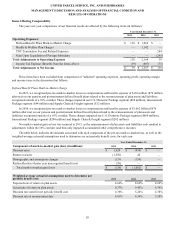

Defined Benefit Plans Mark-to-Market Charge

In 2015, we recognized pre-tax mark-to-market losses in compensation and benefits expense of $118 million ($79 million

after-tax) on our pension and postretirement defined benefit plans related to the remeasurement of plan assets and liabilities

recognized outside of a 10% corridor. These charges impacted our U.S. Domestic Package segment ($62 million), International

Package segment ($44 million) and Supply Chain & Freight segment ($12 million).

In 2014, we recognized pre-tax mark-to-market losses in compensation and benefits expense of $1.062 billion ($670

million after-tax) on our pension and postretirement defined benefit plans related to the remeasurement of plan assets and

liabilities recognized outside of a 10% corridor. These charges impacted our U.S. Domestic Package segment ($660 million),

International Package segment ($200 million) and Supply Chain & Freight segment ($202 million).

No mark-to-market gain or loss was incurred in 2013, as the remeasurement of plan assets and liabilities only resulted in

adjustments within the 10% corridor (and thus only impacted accumulated other comprehensive income).

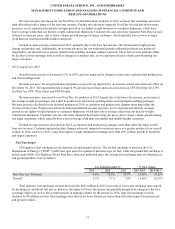

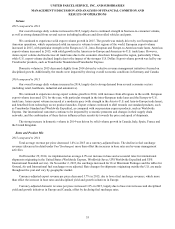

The table below indicates the amounts associated with each component of the pre-tax mark-to-market loss, as well as the

weighted-average actuarial assumptions used to determine our net periodic benefit costs, for each year:

Year Ended December 31,

Components of mark-to-market gain (loss) (in millions): 2015 2014 2013

Discount rates $ 1,624 $ (954)$ —

Return on assets (1,550)42 —

Demographic and assumption changes (133)(150)—

Reclassification of prior year unrecognized benefit cost (59)— —

Total mark-to-market gain (loss) $ (118)$ (1,062)$ —

Weighted-average actuarial assumptions used to determine net

periodic benefit cost: 2015 2014 2013

Expected rate of return on plan assets 8.66% 8.66% 8.69%

Actual rate of return on plan assets 0.37% 9.45% 8.36%

Discount rate used for net periodic benefit cost 4.36% 5.24% 4.38%

Discount rate at measurement date 4.81% 4.36% 5.24%