UPS 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

118

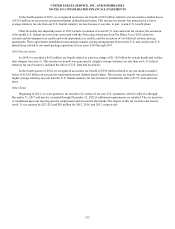

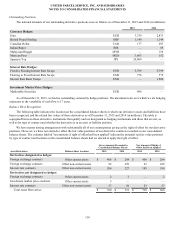

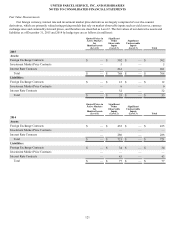

Outstanding Positions

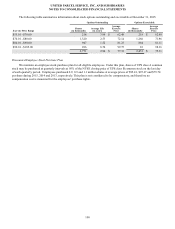

The notional amounts of our outstanding derivative positions were as follows as of December 31, 2015 and 2014 (in millions):

2015 2014

Currency Hedges:

Euro EUR 3,750 2,833

British Pound Sterling GBP 1,140 1,149

Canadian Dollar CAD 177 293

Indian Rupee INR — 85

Malaysian Ringgit MYR — 150

Mexican Peso MXN 3,863 152

Japanese Yen JPY 20,000 —

Interest Rate Hedges:

Fixed to Floating Interest Rate Swaps USD 5,799 5,799

Floating to Fixed Interest Rate Swaps USD 778 779

Interest Rate Basis Swaps USD — 1,500

Investment Market Price Hedges:

Marketable Securities EUR 496 —

As of December 31, 2015, we had no outstanding commodity hedge positions. The maximum term over which we are hedging

exposures to the variability of cash flow is 17 years.

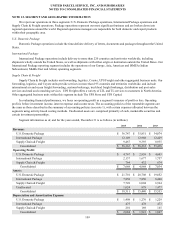

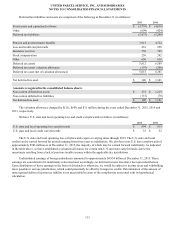

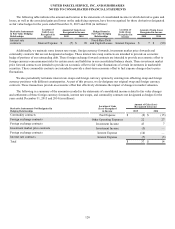

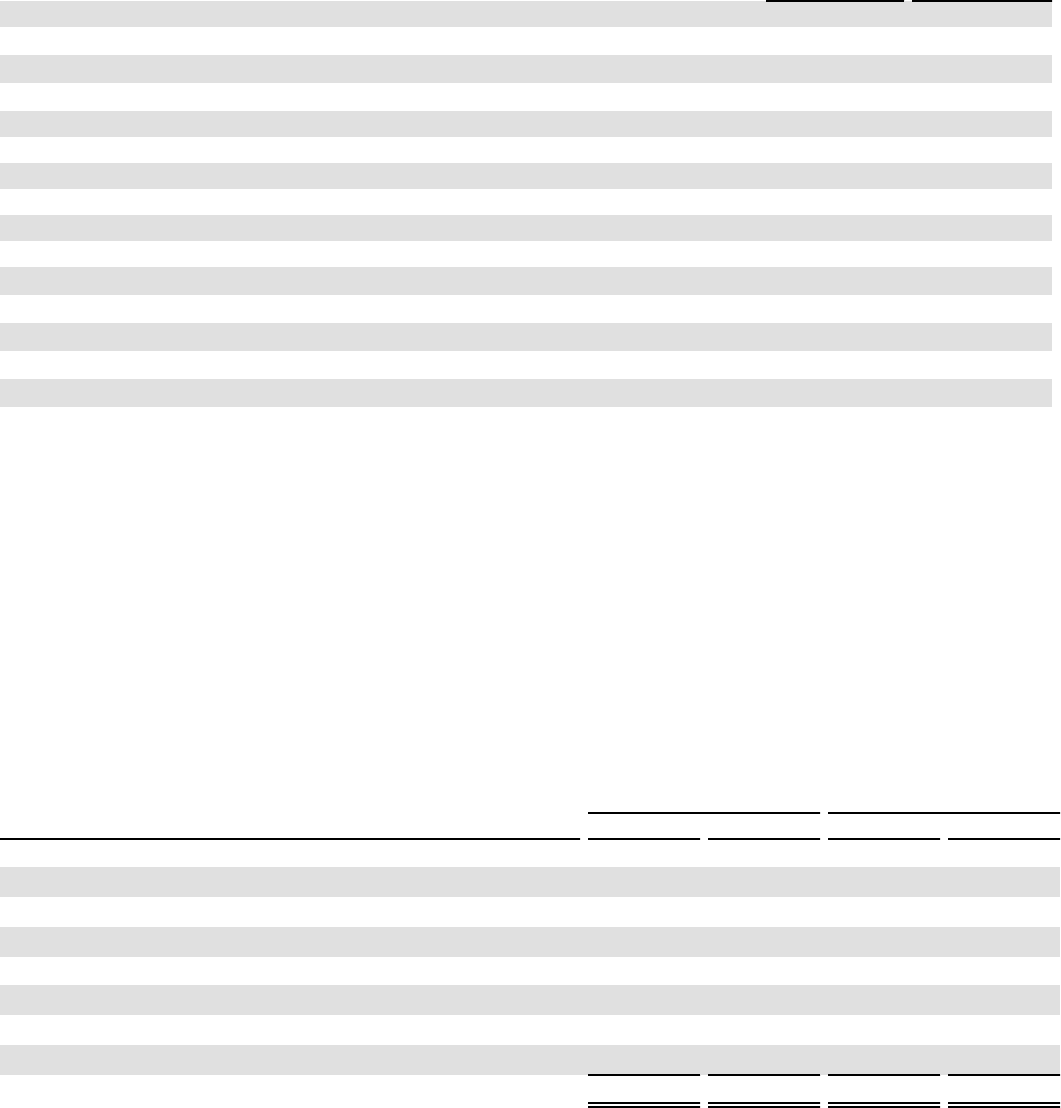

Balance Sheet Recognition

The following table indicates the location on the consolidated balance sheets in which our derivative assets and liabilities have

been recognized, and the related fair values of those derivatives as of December 31, 2015 and 2014 (in millions). The table is

segregated between those derivative instruments that qualify and are designated as hedging instruments and those that are not, as

well as by type of contract and whether the derivative is in an asset or liability position.

We have master netting arrangements with substantially all of our counterparties giving us the right of offset for our derivative

positions. However, we have not elected to offset the fair value positions of our derivative contracts recorded on our consolidated

balance sheets. The columns labeled "net amounts if right of offset had been applied" indicate the potential net fair value positions

by type of contract and location on the consolidated balance sheets had we elected to apply the right of offset.

Gross Amounts Presented in

Consolidated Balance Sheets

Net Amounts if Right of

Offset had been Applied

Asset Derivatives Balance Sheet Location 2015 2014 2015 2014

Derivatives designated as hedges:

Foreign exchange contracts Other current assets $ 408 $ 204 $ 408 $ 204

Foreign exchange contracts Other non-current assets 92 229 92 229

Interest rate contracts Other non-current assets 204 227 185 194

Derivatives not designated as hedges:

Foreign exchange contracts Other current assets 2 2 — 2

Investment market price contracts Other current assets 5———

Interest rate contracts Other non-current assets 57 59 53 57

Total Asset Derivatives $ 768 $ 721 $ 738 $ 686