UPS 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

42

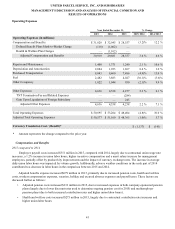

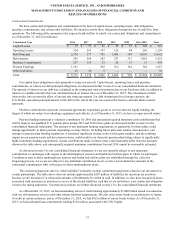

• Workers compensation expense increased $36 million in 2015. Insurance reserves are established for estimates of the

loss that we will ultimately incur on reported worker's compensation claims, as well as estimates of claims that have

been incurred but not reported, and take into account a number of factors including our history of claim losses, payroll

growth and the impact of safety improvement initiatives. In 2015, we experienced less favorable actuarial expense

adjustments than the prior year as well as increased program costs and taxes.

• Vacation, holiday and excused absence expense increased $32 million in 2015, due to an increase in the overall

number of employees and increased vacation entitlements earned based on employees' years of service; however, these

factors were partially offset by the impact of currency exchange rates.

2014 compared to 2013

Employee payroll costs increased $1.054 billion in 2014, compared with 2013, largely due to contractual union wage rate

increases, a 7.5% increase in average daily union labor hours, and a merit salary increase for management employees. The

increase in average daily union labor hours was impacted by volume growth, as well as additional training hours for the

seasonal fourth quarter staffing increase. Additionally, adverse weather conditions in the early part of 2014 contributed to an

increase in labor hours in the year over year comparison.

Adjusted benefits expense increased $270 million in 2014, primarily due to increased health and welfare costs, payroll

taxes, and vacation, holiday and excused absence expenses. However, these factors were partially offset by a reduction in

pension costs and workers compensation expense. These factors are discussed further as follows:

• Adjusted health and welfare costs increased $221 million in 2014, largely due to higher medical claims in company-

sponsored plans, increased contributions to multiemployer plans and the impact of several provisions of the Patient

Protection and Affordable Care Act of 2010. The growth in multiemployer plan contributions was impacted by

contractual contribution rate increases and higher union labor hours.

• Payroll taxes increased $73 million in 2014, primarily as a result of higher union labor hours, union wage rate

increases and higher management incentive compensation payments.

• Vacation, holiday and excused absence expense increased $41 million in 2014, due to an increase in the overall

number of employees and increased vacation entitlements earned based on employees' years of service.

• Adjusted pension costs declined $23 million in 2014, as a decrease in the expense for company-sponsored pension

plans (largely due to higher discount rates used to determine pension cost for 2014) was largely offset by higher

contributions to multiemployer pension plans (due to both increased contribution rates and higher union labor hours).

• Workers compensation expense decreased $69 million in 2014, impacting all segments. Insurance reserves are

established for estimates of the loss that we will ultimately incur on reported worker's compensation claims, as well as

estimates of claims that have been incurred but not reported, and take into account a number of factors including our

history of claim losses, payroll growth and the impact of safety improvement initiatives. In 2014, we experienced

favorable actuarial expense adjustments as the frequency and severity of claims was less than previously projected,

due to the impact of ongoing operational safety improvement and claim management initiatives.

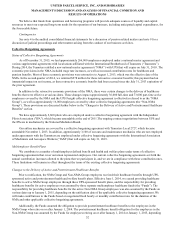

Repairs and Maintenance

2015 compared to 2014

The $29 million increase in repairs and maintenance expense in 2015 was primarily due to an increase in airframe and

aircraft engine repair and component replacement costs, largely in our Boeing 747 and 767 aircraft fleets. The remaining

increase was largely due to increased vehicle maintenance costs in our global package and freight operations, primarily due to

the growth in the size of our vehicle fleet.

2014 compared to 2013

The $131 million increase in repairs and maintenance expense in 2014 was primarily due to a $93 million increase in

airframe and aircraft engine repair and component replacement costs, largely in our Boeing 747 and 767 aircraft fleets. The

remaining increase was largely due to increased vehicle maintenance costs in our global package and freight operations,

primarily due to the growth in the size of our vehicle fleet.