UPS 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

69

Foreign Currency Translation

We translate the results of operations of our foreign subsidiaries using average exchange rates during each period,

whereas balance sheet accounts are translated using exchange rates at the end of each period. Balance sheet currency translation

adjustments are recorded in AOCI. Pre-tax currency transaction gains, net of hedging, included in other operating expenses,

investment income and interest expense were $7, $14 and $76 million in 2015, 2014 and 2013, respectively.

Stock-Based Compensation

All share-based awards to employees are measured based on their fair values and expensed over the period during which

an employee is required to provide service in exchange for the award (the vesting period). We issue employee share-based

awards under the UPS Incentive Compensation Plan that are subject to specific vesting conditions; generally, the awards cliff

vest or vest ratably over a three or five year period (the "nominal vesting period”) or at the date the employee retires (as defined

by the plan), if earlier. Compensation cost is recognized immediately for awards granted to retirement-eligible employees, or

over the period from the grant date to the date retirement eligibility is achieved, if that is expected to occur during the nominal

vesting period.

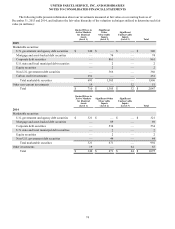

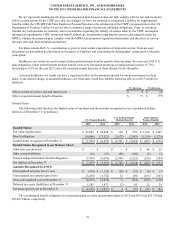

Fair Value Measurements

Our financial assets and liabilities measured at fair value on a recurring basis have been categorized based upon a fair

value hierarchy. Level 1 inputs utilize quoted prices in active markets for identical assets or liabilities. Level 2 inputs are based

on other observable market data, such as quoted prices for similar assets and liabilities, and inputs other than quoted prices that

are observable, such as interest rates and yield curves. Level 3 inputs are developed from unobservable data reflecting our own

assumptions, and include situations where there is little or no market activity for the asset or liability.

Certain non-financial assets and liabilities are measured at fair value on a nonrecurring basis, including property, plant,

and equipment, goodwill and intangible assets. These assets are not measured at fair value on a recurring basis; however, they

are subject to fair value adjustments in certain circumstances, such as when there is evidence of an impairment. A general

description of the valuation methodologies used for assets and liabilities measured at fair value, including the general

classification of such assets and liabilities pursuant to the valuation hierarchy, is included in each footnote with fair value

measurements present.

We allocate the fair value of purchase consideration to the tangible assets acquired, liabilities assumed and intangible

assets acquired based on their estimated fair values. The excess of the fair value of purchase consideration over the fair values

of these identifiable assets and liabilities is recorded as goodwill. Such valuations require management to make significant

estimates and assumptions, especially with respect to intangible assets. Significant estimates in valuing certain intangible assets

include, but are not limited to, future expected cash flows from acquired users, acquired technology, and trade names from a

market participant perspective, useful lives and discount rates. Management’s estimates of fair value are based upon

assumptions believed to be reasonable, but which are inherently uncertain and unpredictable and, as a result, actual results may

differ from estimates. During the measurement period, which is one year from the acquisition date, we may record adjustments

to the assets acquired and liabilities assumed, with the corresponding offset to goodwill. Upon the conclusion of the

measurement period, any subsequent adjustments are recorded to earnings.

Derivative Instruments

All financial derivative instruments are recorded on our consolidated balance sheets at fair value. Derivatives not

designated as hedges must be adjusted to fair value through income. If a derivative is designated as a hedge, changes in its fair

value that are considered to be effective, as defined, either (depending on the nature of the hedge) offset the change in fair value

of the hedged assets, liabilities or firm commitments through income, or are recorded in AOCI until the hedged item is recorded

in income. Any portion of a change in a hedge’s fair value that is considered to be ineffective, or is excluded from the

measurement of effectiveness, is recorded immediately in income.

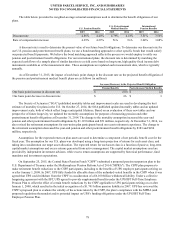

Adoption of New Accounting Standards

In November 2015, the Financial Accounting Standards Board ("FASB") issued an accounting standards update that

simplifies the presentation of deferred tax assets and liabilities. The update removes the requirement to separate deferred tax

liabilities and assets into current and non-current amounts in a classified statement of financial position. The update permits the

entity to present deferred tax liabilities and assets as non-current in a classified statement of financial position. The new

guidance would have become effective for us in the fourth quarter of 2016; however, we have elected to early adopt this