UPS 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Our strong operating performance enables us to

earn record returns for our shareowners. Our free

cash-ow†generation remained robust, at

$5.1 billion, enabling us to raise the dividend by

9 percent in 2015. This is the 46th consecutive year

that we have increased or maintained our dividend

annually. Our strong cash ow also allowed

UPS to fund $2.4 billion in capital expenditures

and repurchase more than $2.7 billion in shares.

We have returned more than $58 billion to

shareowners since going public in 1999.

Operations Review

Ourfocus in2015wastocontinueinvesting

in new capacity and technology. The financial

results weachievedweremadepossibleby

these investments, by ensuring we are properly

compensatedforthevalueweprovide,andbythe

determination and dedication of our people.

Throughout the year, all three segments made

changes to pricing policies and took a disciplined

approach to top-line growth. We worked closely

with customers to improve profitability, while

occasionally stepping away from some low-value

opportunities. These pricing initiatives enabled

ustooffsetthestrong revenueheadwindswe

faced from unfavorable currency conversions and

lowerfuelsurchargerevenues. As a result,adjusted

operating profits* rose 9.2 percent over 2014 on a

0.2increaseintotal revenue.

We also closed on the $1.8 billion acquisition

of Coyote Logistics during the third quarter.

The Coyote acquisition represented the largest

purchase in our history and established UPS as

atop-tiercompetitorintheasset-lighttruckload

brokerageindustry.You’llhearmoreinthecoming

yearaboutthis companyand ourplans toexpand

this unique business model and technology within

the industry and within UPS.

Global Package Operations

Daily shipping volume increased 1.7 percent, with

U.S. Domestic volume growing slightly faster than

International. UPS demonstrated a disciplined

approach to growth in 2015, declining to renew

some lower-yielding contracts while at the

same time improving operating margins. When

combined with the pricing initiatives discussed

earlier, these actions drove package yield higher

in 2015.

Small package operations benefitted from ORION

and delivered high-quality service in the most

efficient manner. Technology implementations

inthepackageoperations and theadditionof

newfacilities acrosstheglobehelped produce

strong operating margin expansion. In total, global

package adjusted operating margin* expanded by

120 basis points, to 14.3 percent in 2015.

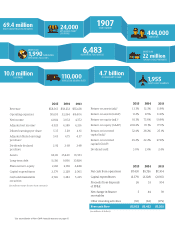

Revenue

(in billions of dollars)

0 102030405

06

0

2014 58.2

2015 58.4

2010 49.5

2011 53.1

2012 54.1

2013 55.4

†See reconciliation of Free Cash Flow on the inside front cover. *See reconciliation of Non-GAAP financial measures on page A1. 3

160104_L01_NARR.indd 3 3/3/16 10:35 PM