UPS 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

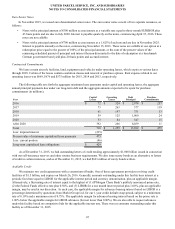

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

106

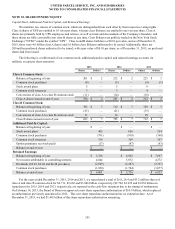

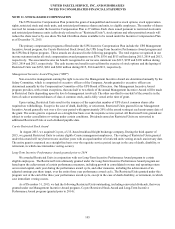

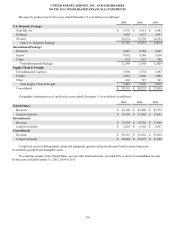

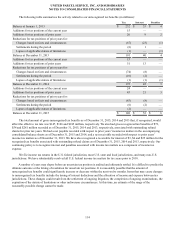

Shares

(in thousands)

Weighted Average

Grant Date

Fair Value

Weighted Average Remaining

Contractual Term

(in years)

Aggregate Intrinsic

Value (in millions)

Nonvested at January 1, 2015 11,559 $ 82.58

Vested (5,867) 80.27

Granted 5,118 100.63

Reinvested Dividends 359 N/A

Forfeited / Expired (157) 90.23

Nonvested at December 31, 2015 11,012 $ 90.71 1.37 $ 1,060

Restricted Units Expected to Vest 10,783 $ 90.77 1.36 $ 1,038

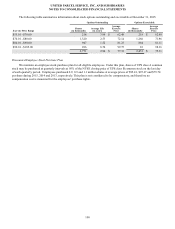

The fair value of each Restricted Unit is the NYSE closing price of class B common stock on the date of grant. The

weighted-average grant date fair value of Restricted Units granted during 2015, 2014 and 2013 was $100.63, $92.35 and

$80.18, respectively. The total fair value of Restricted Units vested was $564, $579 and $510 million in 2015, 2014 and 2013,

respectively. As of December 31, 2015, there was $488 million of total unrecognized compensation cost related to nonvested

Restricted Units. That cost is expected to be recognized over a weighted average period of three years and one month.

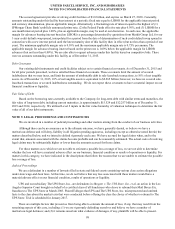

Long-Term Incentive Performance Award granted after 2013

Beginning with the Long-Term Incentive Performance grant in 2014, the performance targets are equally-weighted

among consolidated operating return on invested capital, growth in consolidated revenue, and total shareowner return relative to

a peer group of companies. The Restricted Units granted under this award generally vest at the end of a three-year period

(except in the case of death disability, or retirement, in which case immediate vesting occurs on a prorated basis). The number

of Restricted Units earned will be based on the percentage achievement of the performance targets set forth on the grant date.

The range of percentage achievement can vary from 0% to 200% of the target award.

For the two-thirds of the award related to consolidated operating return on invested capital and growth in consolidated

revenue, we recognize the grant-date fair value of these units (less estimated forfeitures) as compensation expense ratably over

the vesting period, based on the number of awards expected to be earned. The remaining one-third of the award related to total

shareowner return relative to a peer group is valued using a Monte Carlo model. This portion of the award was valued at a share

payout of 65.86% and 109.84% of the target grant in 2015 and 2014, respectively, and is recognized as compensation expense

(less estimated forfeitures) ratably over the vesting period.

As of December 31, 2015, we had the following Restricted Units outstanding, including reinvested dividends, that were

granted under our Long-Term Incentive Performance Award program (granted after 2013):

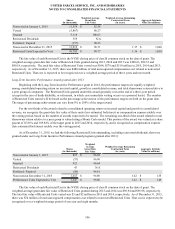

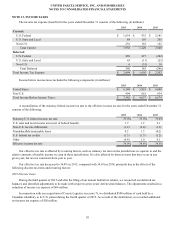

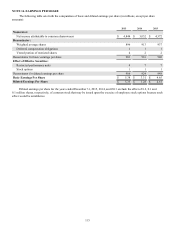

Shares

(in thousands)

Weighted

Average

Grant Date

Fair Value

Weighted Average Remaining

Contractual Term

(in years)

Aggregate Intrinsic

Value (in millions)

Nonvested at January 1, 2015 815 $ 96.98

Vested (57) 96.90

Granted 912 96.64

Reinvested Dividends 43 N/A

Forfeited / Expired (98) 96.81

Nonvested at December 31, 2015 1,615 $ 96.80 1.62 $ 155

Performance Units Expected to Vest 1,547 $ 96.80 1.62 $ 149

The fair value of each Restricted Unit is the NYSE closing price of class B common stock on the date of grant. The

weighted-average grant date fair value of Restricted Units granted during 2015 and 2014 was $96.94 and $96.98, respectively.

The total fair value of Restricted Units vested was $5 and $2 million in 2015 and 2014, respectively. As of December 31, 2015,

there was $74 million of total unrecognized compensation cost related to nonvested Restricted Units. That cost is expected to be

recognized over a weighted average period of one year and eight months.