UPS 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our2015resultsdemonstratethatUPScanthrive

in this changing environment, as shown by our

continued ability to meet the expectations of

customers and investors alike:

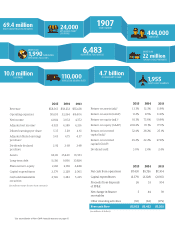

• UPS delivered, on average, more than 18.3 million

packages for our customers each day in 2015,

or 1.7 percent more than the year before. The

e-commerce boom has come with its own set of

challenges – namely, requiring us to continually

optimizeournetworkgiventheriseinless-dense

residential deliveries and the spike in package

volumesaroundholidays.However,thecontinued

rolloutofourproprietaryORIONroute-optimization

software, coupled with our acquisition of Coyote

Logistics and our numerous initiatives to build

more density among shippers, enabled us to boost

operational efficiency. In 2016, we will build on

these initiatives while continuing to automate more

of our hubs across the world.

• Even as we invest, we continue to generate strong

results that position UPS for profitable growth.

Thanks to our focus on revenue management and

operational execution during the peak season, UPS

ended 2015 with record fourth-quarter earnings

per share and our highest operating profit ever.

For the full year, adjusted diluted earnings per

share* increased 14 percent, to $5.43, which was

alsoanall-timehigh.Inaddition,weexceeded

financial expectations in each quarter in 2015,

demonstrating that UPS can fulfill the needs

of our customers while delivering the financial

performance our investors deserve.

• While we continue to

make investments that

improvetheefficiencyof

ournetwork,wearealso

improving the customer’s

experience. We currently

have a series of internal

optimization projects

underway to streamline

our inside operations,

controlcostsandimprove

customer service levels.

•Somehavepredicted

that traditional delivery

services could be

vulnerable to new business models. We

believe these views understate the increasing

importance of customer experience. At UPS,

we’regivingconsumersmoreflexibilitythanever

toreceivepackageswhenandwheretheychoose,

andtomakereturnseasierthanever.Inshort,we

enable shippers to provide their customers with

a stellar end-to-end experience that others can’t.

WeprovideUPScustomerswith thechoice,

convenience and control they deserve with

offerings like UPS My Choice,

® which has grown

to more than 22 million subscribers. In addition,

wecontinuetoexpandthesizeofourUPS Access

Point™ network, which now consists of more than

24,000 remote locations where consumers can

pick up packages on their schedule.

“UPS can thrive

in this changing

environment,

as shown by

our continued

ability to meet

the expectations

of customers and

investors alike.”

63

%

21%

16%

U.S. Domestic Package

International Package

Supply Chain & Freight

Revenue by Segment

(percent)

Revenue by Geography

(percent)

7

8%

22%

U.S.

International

2*See reconciliation of Non-GAAP financial measures on page A1.

160104_L01_NARR.indd 2 3/3/16 9:25 AM