UPS 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

98

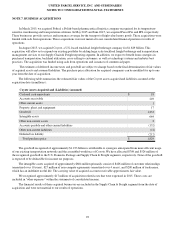

The second agreement provides revolving credit facilities of $3.0 billion, and expires on March 27, 2020 . Generally,

amounts outstanding under this facility bear interest at a periodic fixed rate equal to LIBOR for the applicable interest period

and currency denomination, plus an applicable margin. Alternatively, a fluctuating rate of interest equal to the highest of (1)

JPMorgan Chase Bank’s publicly announced prime rate, (2) the Federal Funds effective rate plus 0.50%, and (3) LIBOR for a

one month interest period plus 1.00%, plus an applicable margin, may be used at our discretion. In each case, the applicable

margin for advances bearing interest based on LIBOR is a percentage determined by quotations from Markit Group Ltd. for our

1-year credit default swap spread, interpolated for a period from the date of determination of such credit default swap spread in

connection with a new interest period until the latest maturity date of this facility then in effect (but not less than a period of one

year). The minimum applicable margin rate is 0.10% and the maximum applicable margin rate is 0.75% per annum. The

applicable margin for advances bearing interest based on the prime rate is 1.00% below the applicable margin for LIBOR

advances (but not less than 0.00%). We are also able to request advances under this facility based on competitive bids. There

were no amounts outstanding under this facility as of December 31, 2015.

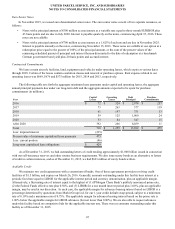

Debt Covenants

Our existing debt instruments and credit facilities subject us to certain financial covenants. As of December 31, 2015 and

for all prior periods presented, we have satisfied these financial covenants. These covenants limit the amount of secured

indebtedness that we may incur, and limit the amount of attributable debt in sale-leaseback transactions, to 10% of net tangible

assets. As of December 31, 2015, 10% of net tangible assets is equivalent to $2.265 billion; however, we have no covered sale-

leaseback transactions or secured indebtedness outstanding. We do not expect these covenants to have a material impact on our

financial condition or liquidity.

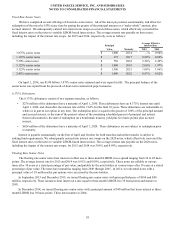

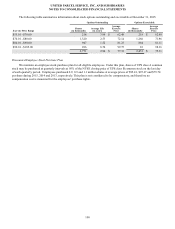

Fair Value of Debt

Based on the borrowing rates currently available to the Company for long-term debt with similar terms and maturities, the

fair value of long-term debt, including current maturities, is approximately $15.524 and $12.257 billion as of December 31,

2015 and 2014, respectively. We utilized Level 2 inputs in the fair value hierarchy of valuation techniques to determine the fair

value of all of our debt instruments.

NOTE 9. LEGAL PROCEEDINGS AND CONTINGENCIES

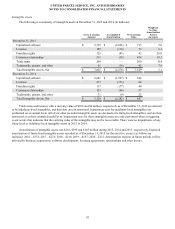

We are involved in a number of judicial proceedings and other matters arising from the conduct of our business activities.

Although there can be no assurance as to the ultimate outcome, we have generally denied, or believe we have a

meritorious defense and will deny, liability in all litigation pending against us, including (except as otherwise noted herein) the

matters described below, and we intend to defend vigorously each case. We have accrued for legal claims when, and to the

extent that, amounts associated with the claims become probable and can be reasonably estimated. The actual costs of resolving

legal claims may be substantially higher or lower than the amounts accrued for those claims.

For those matters as to which we are not able to estimate a possible loss or range of loss, we are not able to determine

whether the loss will have a material adverse effect on our business, financial condition or results of operations or liquidity. For

matters in this category, we have indicated in the descriptions that follow the reasons that we are unable to estimate the possible

loss or range of loss.

Judicial Proceedings

We are a defendant in a number of lawsuits filed in state and federal courts containing various class action allegations

under state wage-and-hour laws. At this time, we do not believe that any loss associated with these matters would have a

material adverse effect on our financial condition, results of operations or liquidity.

UPS and our subsidiary The UPS Store, Inc., are defendants in Morgate v. The UPS Store, Inc. et al. an action in the Los

Angeles Superior Court brought on behalf of a certified class of all franchisees who chose to rebrand their Mail Boxes Etc.

franchises to The UPS Store in March 2003. Plaintiff alleges that UPS and The UPS Store, Inc. misrepresented and omitted

facts to the class about the market tests that were conducted before offering the class the choice of whether to rebrand to The

UPS Store. Trial is scheduled for January 2017.

There are multiple factors that prevent us from being able to estimate the amount of loss, if any, that may result from the

remaining aspects of this case, including: (1) we are vigorously defending ourselves and believe we have a number of

meritorious legal defenses; and (2) it remains uncertain what evidence of damages, if any, plaintiffs will be able to present.